Nov 19, 2025

Articles

Nov 19, 2025

Articles

Nov 19, 2025

Articles

Navigating FDA Food Regulations 2026: Key Changes to Know

Martín Ramírez

Martín Ramírez

Martín Ramírez

Navigating the 2026 FDA Food Regulations for Manufacturers

The regulatory landscape for food and beverage manufacturers is undergoing its most significant transformation in decades. As we move through 2026, compliance professionals face a perfect storm of new FDA requirements—from traceability mandates to artificial dye phase-outs, labeling overhauls to ingredient approval pathway changes. While some deadlines have shifted and enforcement timelines remain uncertain, the message is clear: the time to prepare is now.

For senior compliance managers, regulatory affairs professionals, and quality leaders, understanding these converging regulations isn't just about avoiding enforcement actions. It's about strategic positioning, supply chain resilience, and maintaining consumer trust in an era of unprecedented transparency. This comprehensive guide breaks down every major FDA rule change affecting your products in 2026 and beyond, with the actionable intelligence you need to stay ahead of the curve.

The Food Traceability Rule (FSMA 204): A Delayed Timeline That Still Demands Action

The most talked-about regulation in the food industry right now is undoubtedly the Food Traceability Rule under Section 204 of the Food Safety Modernization Act (FSMA 204). Originally scheduled to take effect on January 20, 2026, this rule has been at the center of intense industry lobbying, congressional action, and regulatory uncertainty.

Major Timeline Update

In a significant development, FDA has proposed to extend the compliance date for the Food Traceability Rule by 30 months to July 20, 2028. This extension provides much-needed breathing room for companies struggling to implement complex traceability systems. However, the delay should not be interpreted as permission to postpone preparation.

Adding another layer of complexity, recent fiscal year 2026 appropriations legislation includes language restricting the use of federal funds to enforce the Food Traceability Rule until its 2028 compliance date. This congressional intervention reflects the political tensions surrounding food safety modernization efforts and suggests that enforcement priorities may continue to evolve.

Understanding the Scope

The Food Traceability Rule applies to businesses that manufacture, process, pack, or hold foods on the FDA's Food Traceability List. This list includes nut butters, many varieties of produce, certain aquatic species, ready-to-eat meatless deli salads, and numerous fresh, soft cheeses—foods identified as high-risk for microbiological or chemical contamination.

The reach is broader than many companies initially realized. All restaurants and food businesses selling food and beverage totaling more than $250,000 annually will be required to provide traceability records, meaning most small and mid-sized operations fall within scope.

What You Must Track

The rule introduces new concepts that will fundamentally change how you document product movement. Every business in the supply chain must maintain records of Critical Tracking Events (CTEs) and Key Data Elements (KDEs) for listed foods.

Required information includes where the product came from, the date and location where your facility accepted the product, the traceability lot-code source information, as well as reference document information. You'll need to develop an electronic traceability plan that clearly describes your procedures for maintaining these records.

Perhaps most challenging is the speed requirement: The FDA will require organizations, including retailers, to provide an electronic sortable spreadsheet of traceability data within 24 hours of request if there is a foodborne illness outbreak or recall. This isn't about having paper files in a warehouse—it demands real-time digital systems that can rapidly retrieve and format data.

Records must be kept for at least two years, and the level of detail required goes beyond traditional lot tracking. You'll need to document how food was sourced, stored, and modified at each step, including temperature data during shipping, freshness dates, and storage conditions.

Technology Infrastructure Requirements

The complexity of these requirements is driving many companies toward third-party technology solutions. Companies typically use their GS1 Global Trade Item Numbers (GTINs) and an internal lot code to create their Traceability Lot Code. You'll also need a Traceability Lot Code Source that includes either a physical address or an FDA Food Facility Registration Number.

Despite the extended timeline, start building your traceability infrastructure now. Supply chain partners need time to align their systems with yours, and testing data exchange protocols across multiple tiers of suppliers can reveal unexpected gaps that require months to resolve.

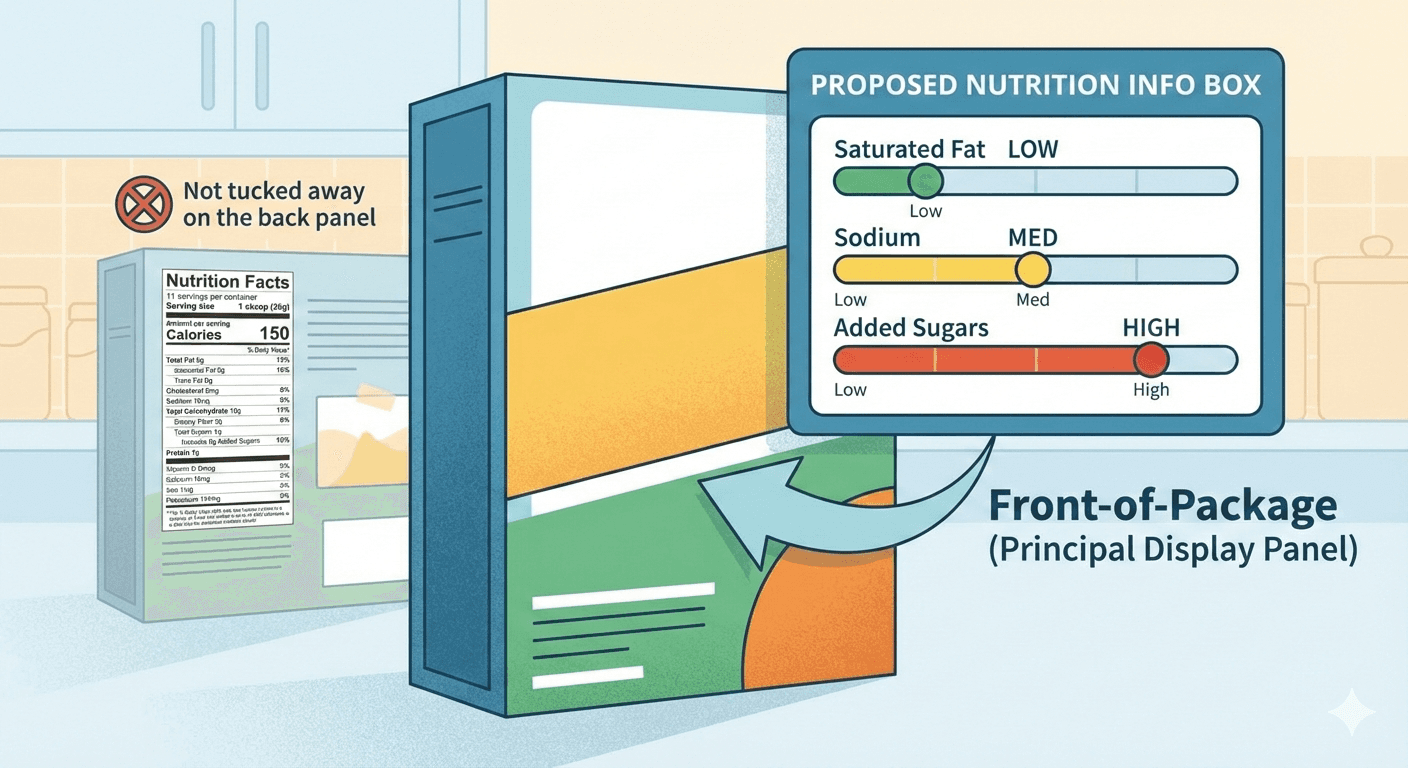

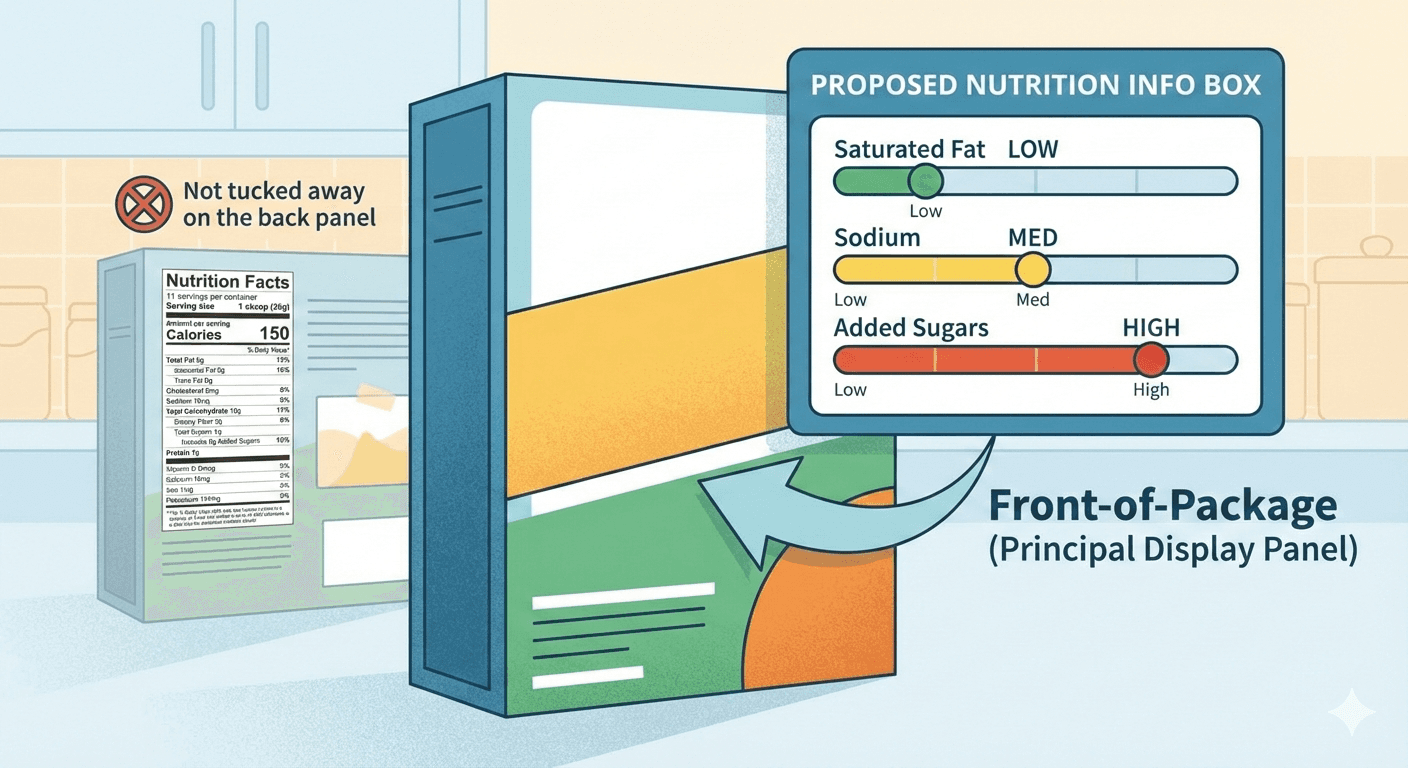

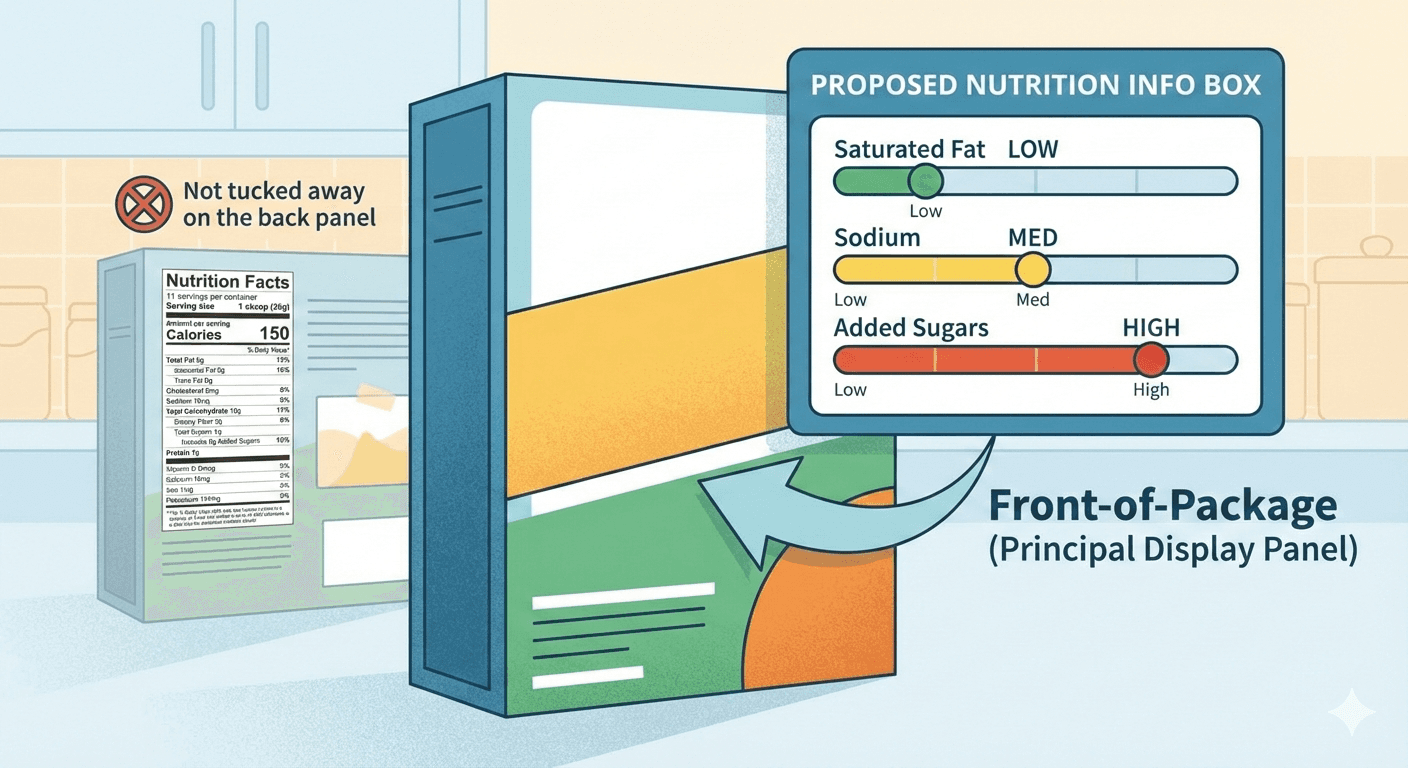

Front-of-Package Nutrition Labeling: The Nutrition Info Box

FDA is proposing one of the most visible changes to packaged food in decades: mandatory front-of-package nutrition labeling that would fundamentally alter how consumers evaluate your products at shelf.

The Proposed Nutrition Info Box

In January 2025, FDA published a proposed rule requiring food manufacturers to display a front-of-package nutrition label on most packaged foods, showing saturated fat, sodium and added sugars content with "Low," "Med" or "High" level indicators. This "Nutrition Info box" would appear on the principal display panel—your product's front face—not tucked away on the back panel like the Nutrition Facts label.

The proposal targets the three nutrients most directly linked to chronic diseases when consumed in excess: saturated fat, sodium, and added sugars. FDA's research, including an experimental study of nearly 10,000 U.S. adults, showed that interpretive labels with simplified schemes help consumers make healthier choices more easily.

FDA extended the comment period for the proposed rule until July 15, 2025, acknowledging the far-reaching implications for packaging design, reformulation strategies, and competitive positioning.

Timeline and Compliance Requirements

If finalized as proposed, the rule would establish a compliance date of three years after the final rule's effective date for businesses with $10 million or more in annual food sales, and four years for businesses with less than $10 million. This means we're realistically looking at 2028-2029 implementation for most companies—but planning must begin immediately.

The packaging implications alone are substantial. Every product face must accommodate a standardized box with nutrient information and interpretive language. For products with limited principal display panel space, this could necessitate complete package redesigns, affecting everything from brand presentation to structural packaging formats.

Strategic Considerations

This rule creates both risks and opportunities. Products currently perceived as indulgent treats may face "High" designations across multiple nutrients, potentially impacting sales. Conversely, products that can claim "Low" across the board gain a powerful new marketing tool.

Reformulation becomes a strategic weapon. Companies willing to invest in reducing saturated fat, sodium, or added sugars can differentiate themselves with favorable front-of-package designations. But reformulation without compromising taste, texture, or shelf life requires significant R&D investment and time—often 18-24 months for complex products.

The competitive landscape will shift. Smaller brands that have built their positioning around "cleaner" ingredient profiles may find themselves with inherent advantages, while established brands with legacy formulations face difficult choices about whether to reformulate iconic products or accept less favorable labeling.

Artificial Food Dye Phase-Out: Red 3 Ban and Beyond

The era of petroleum-based synthetic food dyes is ending, with immediate compliance deadlines and broader industry transformation underway.

Red Dye No. 3: Definitive Timelines

On January 15, 2025, FDA issued an order to revoke authorization for FD&C Red No. 3 in food and ingested drugs, with manufacturers having until January 15, 2027 for food products and January 18, 2028 for drugs to reformulate. This cherry-red dye, used primarily in candy, cakes, cookies, frozen desserts, and frostings, has been banned in cosmetics since 1990 due to cancer concerns in animal studies.

The Red 3 ban is mandatory and enforceable. Unlike some other rules we've discussed, this one has clear statutory authority under the Delaney Clause, which prohibits color additives found to cause cancer in animals. There's no ambiguity here—if your products contain Red 3, you must reformulate or face enforcement action.

The Broader Synthetic Dye Elimination

Red 3 is just the beginning. HHS Secretary Kennedy announced in April 2025 that FDA is working with industry to eliminate six remaining synthetic dyes on the U.S. market—Green 3, Red 40, Yellow 5, Yellow 6, Blue 1, and Blue 2—by the end of 2026. Additionally, FDA has requested that food companies remove Red 3 from their products sooner than the current 2027-2028 deadlines.

This broader phase-out relies primarily on voluntary industry cooperation rather than regulatory mandate, creating uncertainty about timing and enforcement. The plan has been criticized for lacking specifics about what actions FDA will take if companies fail to comply by end of 2026.

Products and Categories Affected

The impact spans virtually every category of processed food and beverage. Red 40 is ubiquitous in sodas, candy, and desserts. Yellow 5 appears in cereals, chips, and flavored drinks. Yellow 6 is used in baked goods, gelatin, and sauces. Blue 1 and Blue 2 color candy coatings, frostings, and beverages. These dyes have been industry staples for decades because of their low cost, bright appearance, and stability.

Reformulating without these workhorses is non-trivial. Natural alternatives exist—beet juice for reds, turmeric for yellows, spirulina for blues, annatto for oranges, butterfly pea flower for purples—but they behave differently. Natural colors can fade with light exposure, shift with pH changes, and require higher usage rates to achieve comparable vibrancy. They're also typically more expensive.

Implementation Strategy

Start reformulation projects now, even for dyes beyond Red 3. The 2026-2027 timeframe is aggressive for complex product portfolios. You'll need to:

Audit all SKUs for synthetic dye usage

Identify natural alternatives that maintain sensory characteristics

Conduct stability testing across shelf life

Validate that natural alternatives don't create new allergens or labeling issues

Plan production transitions and label updates

Communicate changes to consumers who may notice color differences

Budget constraints and recent FDA staff cuts may slow the agency's ability to deliver on synthetic dye elimination timelines, but consumer pressure and state-level bans (like California's restrictions) mean the market is moving regardless of federal enforcement.

GRAS Self-Affirmation Pathway: Major Changes Coming

The Generally Recognized as Safe (GRAS) system—the pathway by which food ingredients are deemed safe for use—is undergoing its most significant overhaul in decades, with profound implications for innovation and product development.

The Proposed Mandatory Notification Rule

FDA added to its spring 2026 agenda a proposed rule requiring mandatory submission of GRAS notices for the use of human and animal food substances. This follows HHS Secretary Kennedy's March 2025 directive to the FDA to explore potential rulemaking to eliminate the self-affirmed GRAS pathway.

Currently, companies can determine an ingredient is GRAS through independent expert panel review without notifying FDA—the self-affirmation pathway. Alternatively, they can voluntarily submit a GRAS notice to FDA for review. The FDA evaluates approximately 75 GRAS notices per year and has completed and published more than 1,000 notices in its public inventory.

The proposed rule would eliminate self-affirmation, requiring all companies to notify FDA before introducing new ingredients. This represents a fundamental shift from a system where FDA oversight is encouraged but optional to one where it's mandatory.

What Changes for Your Ingredient Strategy

The practical implications are substantial. Currently, self-affirmation offers a faster, more confidential pathway to market. Companies can convene expert panels, assess safety data, and proceed without public disclosure of proprietary information or trade secrets. The typical FDA GRAS notification process takes 160+ days on average, and that timeline could extend significantly if notification becomes mandatory and submission volume increases.

Under the proposed rule, substances already listed as GRAS by regulation or that have received a "no questions" letter would be exempted. But any new ingredient not yet determined as GRAS would face mandatory FDA review.

The Innovation Impact

Industry experts warn of a "chilling effect" on ingredient innovation. The self-affirmation pathway has enabled smaller companies and startups to introduce novel ingredients without the resource requirements of full FDA submissions. It has also allowed incremental improvements to existing ingredients—slight modifications to manufacturing processes or formulations—without triggering formal FDA review.

If mandatory notification becomes reality, expect:

Longer development timelines for products using new ingredients

Higher costs for ingredient approval

Potential FDA backlog as submission volume increases

Rush to self-affirm ingredients currently in development before the rule takes effect

Reduced ingredient innovation, particularly from smaller suppliers

The rule is still in proposed form, with rulemaking typically taking several years. However, companies with ingredients in development should consider pursuing self-affirmation now, before the window closes. Once on the GRAS inventory with a "no questions" letter, those ingredients would be grandfathered under the new system.

Plant-Based Milk Alternative Labeling: Draft Guidance Creates New Compliance Questions

The long-running dispute over whether plant-based products can use dairy terminology has resulted in FDA guidance that attempts to split the difference—but may create as many questions as it answers.

Naming Conventions and the "Milk" Debate

FDA's February 2023 draft guidance confirms that common or usual names of some plant-based milk alternatives, such as "soy milk" and "almond milk," have been established by common usage. This was a significant acknowledgment that consumers understand these products are not dairy milk and choose them precisely because they are plant-based alternatives.

However, FDA didn't stop there. The guidance includes a recommendation that may prove more burdensome than the naming question itself.

Voluntary Nutrient Statements

FDA recommends that plant-based milk alternative products labeled with "milk" in their names, such as "soy milk" or "almond milk," and that have a nutrient composition different than milk, include a voluntary nutrient statement on the product label describing how it is nutritionally different, such as "Contains lower amounts of Vitamin D and calcium than milk".

This comparison is based on USDA's Food and Nutrition Service fluid milk substitutes nutrient criteria, which includes nine nutrients: calcium, protein, vitamin A, vitamin D, magnesium, phosphorous, potassium, riboflavin, and vitamin B12.

The statement should appear on the principal display panel—the front of the package—making this a significant packaging and positioning consideration.

The "Voluntary" Problem

Here's where it gets tricky: the guidance is technically voluntary and non-binding. However, legal experts note that draft guidance creates potential liability exposure. Companies that choose to ignore FDA's recommendations may find themselves targets of class action lawsuits claiming their labeling is misleading or fails to follow FDA guidance.

In practice, "voluntary" FDA guidance often becomes de facto mandatory because the litigation risk of non-compliance outweighs the benefit of ignoring it.

Strategic Positioning Challenges

The nutrient statement requirement puts plant-based milk brands in an uncomfortable position. They must either:

Add front-of-package text highlighting nutritional deficiencies compared to dairy milk

Stop using "milk" in the product name and switch to terms like "beverage" or "drink"

Ignore the guidance and accept potential litigation risk

Many plant-based brands built their market position specifically on the "milk" terminology that consumers understand and search for. Switching to "beverage" would create marketing challenges and consumer confusion. But adding statements about lower calcium or protein creates negative framing at the exact moment of purchase decision.

The dairy industry, meanwhile, continues to push for stricter enforcement of standards of identity that would prohibit "milk" terminology entirely on non-dairy products, making this guidance potentially just one chapter in an ongoing regulatory battle.

Sesame Allergen Requirements: Compliance Continues to Evolve

While sesame became the ninth major food allergen effective January 1, 2023, the implementation continues to create challenges and evolve through 2026.

The Ongoing Transition

Sesame is required to be labeled as an allergen on packaged foods, including dietary supplements, as of January 1, 2023. However, because products manufactured before 2023 were not required to be removed from the marketplace, some products without sesame allergen labeling may still be found on store shelves, particularly canned and frozen foods with longer shelf lives.

The bigger issue has been an unintended consequence of the allergen designation: some manufacturers began intentionally adding sesame to products that previously didn't contain it, rather than implementing controls to prevent cross-contact. This technically kept them in compliance with allergen disclosure requirements but reduced options for sesame-allergic consumers.

FDA updated its draft guidance in 2023 to address food manufacturers circumventing allergen cross-contact requirements by intentionally adding sesame to products, denouncing this practice as limiting options for consumers with sesame allergies.

Chapter 11: Food Allergen Program

FDA's updated guidance includes a new chapter on establishing and implementing food allergen programs. This provides specific examples of ways to significantly minimize or prevent allergen cross-contact using current good manufacturing practices and preventive controls.

The guidance emphasizes that labeling errors cause most FDA food allergen recalls. It includes recommendations for monitoring and verifying that allergens are properly declared and correct labels are used. For situations where, despite appropriate controls, allergen cross-contact cannot be completely avoided, FDA discusses options including voluntary allergen advisory statements.

2026 Compliance Priorities

For sesame allergen management in 2026:

Review your allergen control programs to ensure robust cross-contact prevention

Verify that sesame is properly identified when present as part of other ingredients like "natural flavor" or "spice mix"

If using "Contains" statements, ensure sesame is included when present

Train employees on all nine major food allergens (sesame is frequently overlooked as the newest addition)

Document your allergen program and controls in writing

Uniform Compliance Date for Food Labeling: Coordinated Planning Opportunity

In a move designed to reduce industry burden, FDA is providing regulatory relief through uniform compliance dates for new labeling requirements.

The Uniform Date Framework

FDA announced that January 1, 2028 will be the uniform compliance date for final food labeling regulations that are published between January 1, 2025 and December 31, 2026. This allows companies to adjust to new labeling requirements in an orderly and economical manner by planning for the use of existing label inventories and coordinating the development of new labeling materials.

Rather than scrambling to implement each labeling change separately as rules are finalized, you can consolidate multiple requirements into a single label redesign cycle. This reduces costs for artwork development, plate creation, and inventory management.

Strategic Advantage

Use this uniform date strategically. If multiple labeling rules finalize during 2025-2026 (which seems likely given the regulatory agenda), you can:

Conduct a single comprehensive label review covering all new requirements

Coordinate with packaging suppliers for one redesign cycle

Plan inventory drawdown of current labels to conclude by late 2027

Time any voluntary label enhancements (like clean label claims or certifications) to coincide with the mandatory changes

FDA generally encourages industry to comply with new labeling regulations as quickly as feasible, so early adoption may provide competitive advantages, particularly for requirements that resonate with consumer preferences.

Standards of Identity Revocations: Deregulation and Flexibility

In a deregulatory move, FDA is eliminating dozens of obsolete food standards that no longer serve their original protective purpose.

The Revocation Proposal

FDA announced it is revoking or proposing to revoke 52 food standards of identity after concluding they are obsolete and unnecessary, covering canned fruits and vegetables, dairy products, baked goods, macaroni products and other foods.

This includes a direct final rule revoking standards for 11 types of canned fruits and vegetables no longer sold in U.S. grocery stores, including seven standards for fruits artificially sweetened with saccharin. A separate proposed rule would revoke standards for 23 additional types of food products including bakery products, macaroni and noodle products, canned fruit juices, fish and shellfish, and food dressings and flavorings.

Why This Matters

Many of these standards predate modern consumer protections like ingredient safety requirements, ingredient labeling, food packaging regulations, safe manufacturing practices, and nutrition labeling. They've become regulatory fossils—constraining innovation without providing meaningful consumer protection.

Removing obsolete standards creates flexibility for reformulation, particularly for:

Reducing sodium or sugar in standardized foods

Incorporating new ingredients or processing technologies

Responding to consumer preferences for cleaner labels

Improving sustainability of formulations

This aligns with the broader HHS and FDA deregulation initiative under the "Unleashing Prosperity Through Deregulation" executive order, focusing regulatory resources where they provide genuine public health benefit.

Strategic Action Plan: Navigating 2026 and Beyond

With multiple regulations converging, compliance professionals need a phased, strategic approach to manage the transformation.

Immediate Priorities (Now Through 2025)

Assess Traceability Readiness: Don't let the July 2028 delay lull you into complacency. Begin developing your electronic traceability plan and identifying technology solutions now. Pilot programs with key suppliers will reveal integration challenges that take months to resolve.

Monitor GRAS Status of Ingredients: If you're using self-affirmed GRAS ingredients, understand their status and have contingency plans if the mandatory notification rule finalizes. Consider pursuing formal GRAS notifications for critical proprietary ingredients before the self-affirmation window closes.

Initiate Red 3 Reformulation: The January 2027 deadline for Red 3 elimination is non-negotiable. If you haven't started reformulation, you're behind. Natural red alternatives require extensive stability and sensory testing.

Track Front-of-Package Rule: Monitor FDA's final rule publication. When it drops, you'll have 3-4 years for implementation, but reformulation projects to improve nutrient profiles should start earlier to beat competitors to market with favorable labels.

2026 Planning Cycle

Technology Infrastructure Investment: Budget for traceability systems, whether building internal capabilities or contracting with third-party solutions. The requirement to provide electronic sortable spreadsheets within 24 hours means manual systems won't cut it.

Supplier Relationship Management: Traceability requires seamless data exchange with suppliers. Establish standardized formats for KDEs, clarify roles and responsibilities, and conduct trial data exchanges to identify gaps.

Comprehensive Reformulation Roadmap: Map all products containing synthetic dyes beyond Red 3. Prioritize based on sales volume, technical complexity, and competitive positioning. Plan production transitions to minimize waste of dyed ingredients.

Label Redesign Strategy: With the January 2028 uniform compliance date, plan a coordinated approach to any labeling changes finalized in 2025-2026. Include front-of-package nutrition labeling scenario planning in case that rule finalizes.

2027-2028 Implementation

Full Traceability Deployment: With the July 2028 compliance date, complete buildout of traceability systems across all relevant product lines and supply chain partners by mid-2028. Allow buffer time for testing and troubleshooting.

Synthetic Dye Elimination Completion: Ensure all reformulations are complete, validated, and in production well before applicable deadlines. Plan consumer communication strategies if sensory changes are noticeable.

Unified Labeling Compliance: Execute the January 2028 labeling transition, ensuring all affected products bear compliant labels by the deadline.

GRAS Submission Protocols: If mandatory notification rules finalize, establish internal processes for GRAS submissions including expert panel identification, data compilation, and FDA interaction management.

Building Organizational Resilience

Cross-Functional Compliance Teams: These regulations span R&D, operations, supply chain, quality, legal, and marketing. Create standing cross-functional teams with clear decision rights and escalation paths.

Regulatory Intelligence Systems: The pace and complexity of regulatory change demands systematic monitoring. Whether through external services or internal capabilities, establish reliable mechanisms to track proposed rules, comment periods, guidance documents, and enforcement actions.

Scenario Planning and Risk Assessment: Not all proposed rules will finalize as written. Develop "if/then" plans for various regulatory outcomes, with trigger points for activating different response strategies.

Budget Allocation: Compliance isn't optional, but it competes with other priorities for resources. Make the business case early for reformulation, technology, and consulting support. Compliance delays often cost more than proactive investment.

Conclusion: Preparation Is Your Competitive Advantage

2026 represents a regulatory inflection point for the food and beverage industry. The convergence of traceability requirements, labeling mandates, synthetic dye elimination, and ingredient approval pathway changes would be challenging enough individually. Together, they demand unprecedented coordination, investment, and strategic foresight.

While timeline extensions and enforcement uncertainties create temptation to delay action, the competitive advantage belongs to companies that prepare proactively. Early adopters of traceability systems will respond faster to recall situations, protecting brand reputation. Companies that reformulate ahead of synthetic dye deadlines can market their "no artificial colors" positioning before it becomes mandatory. Businesses that master the new GRAS notification process will accelerate innovation while competitors struggle with unfamiliar procedures.

The regulatory environment will continue evolving, particularly as the "Make America Healthy Again" agenda shapes FDA priorities and Congressional action influences enforcement. Participate in comment periods when rules impact your products. Engage with industry associations to shape implementation guidance. Build relationships with FDA staff who can provide compliance assistance.

Most importantly, recognize that these rules reflect genuine public health concerns and consumer demands for transparency, safety, and healthier options. Companies that view compliance as an opportunity to align with these values—rather than merely a cost to minimize—will build stronger brands and more resilient businesses.

The transformation of food regulation is underway. Your response today determines whether you lead the change or struggle to keep pace. Start planning now. Your 2028 self will thank you.

Navigating the 2026 FDA Food Regulations for Manufacturers

The regulatory landscape for food and beverage manufacturers is undergoing its most significant transformation in decades. As we move through 2026, compliance professionals face a perfect storm of new FDA requirements—from traceability mandates to artificial dye phase-outs, labeling overhauls to ingredient approval pathway changes. While some deadlines have shifted and enforcement timelines remain uncertain, the message is clear: the time to prepare is now.

For senior compliance managers, regulatory affairs professionals, and quality leaders, understanding these converging regulations isn't just about avoiding enforcement actions. It's about strategic positioning, supply chain resilience, and maintaining consumer trust in an era of unprecedented transparency. This comprehensive guide breaks down every major FDA rule change affecting your products in 2026 and beyond, with the actionable intelligence you need to stay ahead of the curve.

The Food Traceability Rule (FSMA 204): A Delayed Timeline That Still Demands Action

The most talked-about regulation in the food industry right now is undoubtedly the Food Traceability Rule under Section 204 of the Food Safety Modernization Act (FSMA 204). Originally scheduled to take effect on January 20, 2026, this rule has been at the center of intense industry lobbying, congressional action, and regulatory uncertainty.

Major Timeline Update

In a significant development, FDA has proposed to extend the compliance date for the Food Traceability Rule by 30 months to July 20, 2028. This extension provides much-needed breathing room for companies struggling to implement complex traceability systems. However, the delay should not be interpreted as permission to postpone preparation.

Adding another layer of complexity, recent fiscal year 2026 appropriations legislation includes language restricting the use of federal funds to enforce the Food Traceability Rule until its 2028 compliance date. This congressional intervention reflects the political tensions surrounding food safety modernization efforts and suggests that enforcement priorities may continue to evolve.

Understanding the Scope

The Food Traceability Rule applies to businesses that manufacture, process, pack, or hold foods on the FDA's Food Traceability List. This list includes nut butters, many varieties of produce, certain aquatic species, ready-to-eat meatless deli salads, and numerous fresh, soft cheeses—foods identified as high-risk for microbiological or chemical contamination.

The reach is broader than many companies initially realized. All restaurants and food businesses selling food and beverage totaling more than $250,000 annually will be required to provide traceability records, meaning most small and mid-sized operations fall within scope.

What You Must Track

The rule introduces new concepts that will fundamentally change how you document product movement. Every business in the supply chain must maintain records of Critical Tracking Events (CTEs) and Key Data Elements (KDEs) for listed foods.

Required information includes where the product came from, the date and location where your facility accepted the product, the traceability lot-code source information, as well as reference document information. You'll need to develop an electronic traceability plan that clearly describes your procedures for maintaining these records.

Perhaps most challenging is the speed requirement: The FDA will require organizations, including retailers, to provide an electronic sortable spreadsheet of traceability data within 24 hours of request if there is a foodborne illness outbreak or recall. This isn't about having paper files in a warehouse—it demands real-time digital systems that can rapidly retrieve and format data.

Records must be kept for at least two years, and the level of detail required goes beyond traditional lot tracking. You'll need to document how food was sourced, stored, and modified at each step, including temperature data during shipping, freshness dates, and storage conditions.

Technology Infrastructure Requirements

The complexity of these requirements is driving many companies toward third-party technology solutions. Companies typically use their GS1 Global Trade Item Numbers (GTINs) and an internal lot code to create their Traceability Lot Code. You'll also need a Traceability Lot Code Source that includes either a physical address or an FDA Food Facility Registration Number.

Despite the extended timeline, start building your traceability infrastructure now. Supply chain partners need time to align their systems with yours, and testing data exchange protocols across multiple tiers of suppliers can reveal unexpected gaps that require months to resolve.

Front-of-Package Nutrition Labeling: The Nutrition Info Box

FDA is proposing one of the most visible changes to packaged food in decades: mandatory front-of-package nutrition labeling that would fundamentally alter how consumers evaluate your products at shelf.

The Proposed Nutrition Info Box

In January 2025, FDA published a proposed rule requiring food manufacturers to display a front-of-package nutrition label on most packaged foods, showing saturated fat, sodium and added sugars content with "Low," "Med" or "High" level indicators. This "Nutrition Info box" would appear on the principal display panel—your product's front face—not tucked away on the back panel like the Nutrition Facts label.

The proposal targets the three nutrients most directly linked to chronic diseases when consumed in excess: saturated fat, sodium, and added sugars. FDA's research, including an experimental study of nearly 10,000 U.S. adults, showed that interpretive labels with simplified schemes help consumers make healthier choices more easily.

FDA extended the comment period for the proposed rule until July 15, 2025, acknowledging the far-reaching implications for packaging design, reformulation strategies, and competitive positioning.

Timeline and Compliance Requirements

If finalized as proposed, the rule would establish a compliance date of three years after the final rule's effective date for businesses with $10 million or more in annual food sales, and four years for businesses with less than $10 million. This means we're realistically looking at 2028-2029 implementation for most companies—but planning must begin immediately.

The packaging implications alone are substantial. Every product face must accommodate a standardized box with nutrient information and interpretive language. For products with limited principal display panel space, this could necessitate complete package redesigns, affecting everything from brand presentation to structural packaging formats.

Strategic Considerations

This rule creates both risks and opportunities. Products currently perceived as indulgent treats may face "High" designations across multiple nutrients, potentially impacting sales. Conversely, products that can claim "Low" across the board gain a powerful new marketing tool.

Reformulation becomes a strategic weapon. Companies willing to invest in reducing saturated fat, sodium, or added sugars can differentiate themselves with favorable front-of-package designations. But reformulation without compromising taste, texture, or shelf life requires significant R&D investment and time—often 18-24 months for complex products.

The competitive landscape will shift. Smaller brands that have built their positioning around "cleaner" ingredient profiles may find themselves with inherent advantages, while established brands with legacy formulations face difficult choices about whether to reformulate iconic products or accept less favorable labeling.

Artificial Food Dye Phase-Out: Red 3 Ban and Beyond

The era of petroleum-based synthetic food dyes is ending, with immediate compliance deadlines and broader industry transformation underway.

Red Dye No. 3: Definitive Timelines

On January 15, 2025, FDA issued an order to revoke authorization for FD&C Red No. 3 in food and ingested drugs, with manufacturers having until January 15, 2027 for food products and January 18, 2028 for drugs to reformulate. This cherry-red dye, used primarily in candy, cakes, cookies, frozen desserts, and frostings, has been banned in cosmetics since 1990 due to cancer concerns in animal studies.

The Red 3 ban is mandatory and enforceable. Unlike some other rules we've discussed, this one has clear statutory authority under the Delaney Clause, which prohibits color additives found to cause cancer in animals. There's no ambiguity here—if your products contain Red 3, you must reformulate or face enforcement action.

The Broader Synthetic Dye Elimination

Red 3 is just the beginning. HHS Secretary Kennedy announced in April 2025 that FDA is working with industry to eliminate six remaining synthetic dyes on the U.S. market—Green 3, Red 40, Yellow 5, Yellow 6, Blue 1, and Blue 2—by the end of 2026. Additionally, FDA has requested that food companies remove Red 3 from their products sooner than the current 2027-2028 deadlines.

This broader phase-out relies primarily on voluntary industry cooperation rather than regulatory mandate, creating uncertainty about timing and enforcement. The plan has been criticized for lacking specifics about what actions FDA will take if companies fail to comply by end of 2026.

Products and Categories Affected

The impact spans virtually every category of processed food and beverage. Red 40 is ubiquitous in sodas, candy, and desserts. Yellow 5 appears in cereals, chips, and flavored drinks. Yellow 6 is used in baked goods, gelatin, and sauces. Blue 1 and Blue 2 color candy coatings, frostings, and beverages. These dyes have been industry staples for decades because of their low cost, bright appearance, and stability.

Reformulating without these workhorses is non-trivial. Natural alternatives exist—beet juice for reds, turmeric for yellows, spirulina for blues, annatto for oranges, butterfly pea flower for purples—but they behave differently. Natural colors can fade with light exposure, shift with pH changes, and require higher usage rates to achieve comparable vibrancy. They're also typically more expensive.

Implementation Strategy

Start reformulation projects now, even for dyes beyond Red 3. The 2026-2027 timeframe is aggressive for complex product portfolios. You'll need to:

Audit all SKUs for synthetic dye usage

Identify natural alternatives that maintain sensory characteristics

Conduct stability testing across shelf life

Validate that natural alternatives don't create new allergens or labeling issues

Plan production transitions and label updates

Communicate changes to consumers who may notice color differences

Budget constraints and recent FDA staff cuts may slow the agency's ability to deliver on synthetic dye elimination timelines, but consumer pressure and state-level bans (like California's restrictions) mean the market is moving regardless of federal enforcement.

GRAS Self-Affirmation Pathway: Major Changes Coming

The Generally Recognized as Safe (GRAS) system—the pathway by which food ingredients are deemed safe for use—is undergoing its most significant overhaul in decades, with profound implications for innovation and product development.

The Proposed Mandatory Notification Rule

FDA added to its spring 2026 agenda a proposed rule requiring mandatory submission of GRAS notices for the use of human and animal food substances. This follows HHS Secretary Kennedy's March 2025 directive to the FDA to explore potential rulemaking to eliminate the self-affirmed GRAS pathway.

Currently, companies can determine an ingredient is GRAS through independent expert panel review without notifying FDA—the self-affirmation pathway. Alternatively, they can voluntarily submit a GRAS notice to FDA for review. The FDA evaluates approximately 75 GRAS notices per year and has completed and published more than 1,000 notices in its public inventory.

The proposed rule would eliminate self-affirmation, requiring all companies to notify FDA before introducing new ingredients. This represents a fundamental shift from a system where FDA oversight is encouraged but optional to one where it's mandatory.

What Changes for Your Ingredient Strategy

The practical implications are substantial. Currently, self-affirmation offers a faster, more confidential pathway to market. Companies can convene expert panels, assess safety data, and proceed without public disclosure of proprietary information or trade secrets. The typical FDA GRAS notification process takes 160+ days on average, and that timeline could extend significantly if notification becomes mandatory and submission volume increases.

Under the proposed rule, substances already listed as GRAS by regulation or that have received a "no questions" letter would be exempted. But any new ingredient not yet determined as GRAS would face mandatory FDA review.

The Innovation Impact

Industry experts warn of a "chilling effect" on ingredient innovation. The self-affirmation pathway has enabled smaller companies and startups to introduce novel ingredients without the resource requirements of full FDA submissions. It has also allowed incremental improvements to existing ingredients—slight modifications to manufacturing processes or formulations—without triggering formal FDA review.

If mandatory notification becomes reality, expect:

Longer development timelines for products using new ingredients

Higher costs for ingredient approval

Potential FDA backlog as submission volume increases

Rush to self-affirm ingredients currently in development before the rule takes effect

Reduced ingredient innovation, particularly from smaller suppliers

The rule is still in proposed form, with rulemaking typically taking several years. However, companies with ingredients in development should consider pursuing self-affirmation now, before the window closes. Once on the GRAS inventory with a "no questions" letter, those ingredients would be grandfathered under the new system.

Plant-Based Milk Alternative Labeling: Draft Guidance Creates New Compliance Questions

The long-running dispute over whether plant-based products can use dairy terminology has resulted in FDA guidance that attempts to split the difference—but may create as many questions as it answers.

Naming Conventions and the "Milk" Debate

FDA's February 2023 draft guidance confirms that common or usual names of some plant-based milk alternatives, such as "soy milk" and "almond milk," have been established by common usage. This was a significant acknowledgment that consumers understand these products are not dairy milk and choose them precisely because they are plant-based alternatives.

However, FDA didn't stop there. The guidance includes a recommendation that may prove more burdensome than the naming question itself.

Voluntary Nutrient Statements

FDA recommends that plant-based milk alternative products labeled with "milk" in their names, such as "soy milk" or "almond milk," and that have a nutrient composition different than milk, include a voluntary nutrient statement on the product label describing how it is nutritionally different, such as "Contains lower amounts of Vitamin D and calcium than milk".

This comparison is based on USDA's Food and Nutrition Service fluid milk substitutes nutrient criteria, which includes nine nutrients: calcium, protein, vitamin A, vitamin D, magnesium, phosphorous, potassium, riboflavin, and vitamin B12.

The statement should appear on the principal display panel—the front of the package—making this a significant packaging and positioning consideration.

The "Voluntary" Problem

Here's where it gets tricky: the guidance is technically voluntary and non-binding. However, legal experts note that draft guidance creates potential liability exposure. Companies that choose to ignore FDA's recommendations may find themselves targets of class action lawsuits claiming their labeling is misleading or fails to follow FDA guidance.

In practice, "voluntary" FDA guidance often becomes de facto mandatory because the litigation risk of non-compliance outweighs the benefit of ignoring it.

Strategic Positioning Challenges

The nutrient statement requirement puts plant-based milk brands in an uncomfortable position. They must either:

Add front-of-package text highlighting nutritional deficiencies compared to dairy milk

Stop using "milk" in the product name and switch to terms like "beverage" or "drink"

Ignore the guidance and accept potential litigation risk

Many plant-based brands built their market position specifically on the "milk" terminology that consumers understand and search for. Switching to "beverage" would create marketing challenges and consumer confusion. But adding statements about lower calcium or protein creates negative framing at the exact moment of purchase decision.

The dairy industry, meanwhile, continues to push for stricter enforcement of standards of identity that would prohibit "milk" terminology entirely on non-dairy products, making this guidance potentially just one chapter in an ongoing regulatory battle.

Sesame Allergen Requirements: Compliance Continues to Evolve

While sesame became the ninth major food allergen effective January 1, 2023, the implementation continues to create challenges and evolve through 2026.

The Ongoing Transition

Sesame is required to be labeled as an allergen on packaged foods, including dietary supplements, as of January 1, 2023. However, because products manufactured before 2023 were not required to be removed from the marketplace, some products without sesame allergen labeling may still be found on store shelves, particularly canned and frozen foods with longer shelf lives.

The bigger issue has been an unintended consequence of the allergen designation: some manufacturers began intentionally adding sesame to products that previously didn't contain it, rather than implementing controls to prevent cross-contact. This technically kept them in compliance with allergen disclosure requirements but reduced options for sesame-allergic consumers.

FDA updated its draft guidance in 2023 to address food manufacturers circumventing allergen cross-contact requirements by intentionally adding sesame to products, denouncing this practice as limiting options for consumers with sesame allergies.

Chapter 11: Food Allergen Program

FDA's updated guidance includes a new chapter on establishing and implementing food allergen programs. This provides specific examples of ways to significantly minimize or prevent allergen cross-contact using current good manufacturing practices and preventive controls.

The guidance emphasizes that labeling errors cause most FDA food allergen recalls. It includes recommendations for monitoring and verifying that allergens are properly declared and correct labels are used. For situations where, despite appropriate controls, allergen cross-contact cannot be completely avoided, FDA discusses options including voluntary allergen advisory statements.

2026 Compliance Priorities

For sesame allergen management in 2026:

Review your allergen control programs to ensure robust cross-contact prevention

Verify that sesame is properly identified when present as part of other ingredients like "natural flavor" or "spice mix"

If using "Contains" statements, ensure sesame is included when present

Train employees on all nine major food allergens (sesame is frequently overlooked as the newest addition)

Document your allergen program and controls in writing

Uniform Compliance Date for Food Labeling: Coordinated Planning Opportunity

In a move designed to reduce industry burden, FDA is providing regulatory relief through uniform compliance dates for new labeling requirements.

The Uniform Date Framework

FDA announced that January 1, 2028 will be the uniform compliance date for final food labeling regulations that are published between January 1, 2025 and December 31, 2026. This allows companies to adjust to new labeling requirements in an orderly and economical manner by planning for the use of existing label inventories and coordinating the development of new labeling materials.

Rather than scrambling to implement each labeling change separately as rules are finalized, you can consolidate multiple requirements into a single label redesign cycle. This reduces costs for artwork development, plate creation, and inventory management.

Strategic Advantage

Use this uniform date strategically. If multiple labeling rules finalize during 2025-2026 (which seems likely given the regulatory agenda), you can:

Conduct a single comprehensive label review covering all new requirements

Coordinate with packaging suppliers for one redesign cycle

Plan inventory drawdown of current labels to conclude by late 2027

Time any voluntary label enhancements (like clean label claims or certifications) to coincide with the mandatory changes

FDA generally encourages industry to comply with new labeling regulations as quickly as feasible, so early adoption may provide competitive advantages, particularly for requirements that resonate with consumer preferences.

Standards of Identity Revocations: Deregulation and Flexibility

In a deregulatory move, FDA is eliminating dozens of obsolete food standards that no longer serve their original protective purpose.

The Revocation Proposal

FDA announced it is revoking or proposing to revoke 52 food standards of identity after concluding they are obsolete and unnecessary, covering canned fruits and vegetables, dairy products, baked goods, macaroni products and other foods.

This includes a direct final rule revoking standards for 11 types of canned fruits and vegetables no longer sold in U.S. grocery stores, including seven standards for fruits artificially sweetened with saccharin. A separate proposed rule would revoke standards for 23 additional types of food products including bakery products, macaroni and noodle products, canned fruit juices, fish and shellfish, and food dressings and flavorings.

Why This Matters

Many of these standards predate modern consumer protections like ingredient safety requirements, ingredient labeling, food packaging regulations, safe manufacturing practices, and nutrition labeling. They've become regulatory fossils—constraining innovation without providing meaningful consumer protection.

Removing obsolete standards creates flexibility for reformulation, particularly for:

Reducing sodium or sugar in standardized foods

Incorporating new ingredients or processing technologies

Responding to consumer preferences for cleaner labels

Improving sustainability of formulations

This aligns with the broader HHS and FDA deregulation initiative under the "Unleashing Prosperity Through Deregulation" executive order, focusing regulatory resources where they provide genuine public health benefit.

Strategic Action Plan: Navigating 2026 and Beyond

With multiple regulations converging, compliance professionals need a phased, strategic approach to manage the transformation.

Immediate Priorities (Now Through 2025)

Assess Traceability Readiness: Don't let the July 2028 delay lull you into complacency. Begin developing your electronic traceability plan and identifying technology solutions now. Pilot programs with key suppliers will reveal integration challenges that take months to resolve.

Monitor GRAS Status of Ingredients: If you're using self-affirmed GRAS ingredients, understand their status and have contingency plans if the mandatory notification rule finalizes. Consider pursuing formal GRAS notifications for critical proprietary ingredients before the self-affirmation window closes.

Initiate Red 3 Reformulation: The January 2027 deadline for Red 3 elimination is non-negotiable. If you haven't started reformulation, you're behind. Natural red alternatives require extensive stability and sensory testing.

Track Front-of-Package Rule: Monitor FDA's final rule publication. When it drops, you'll have 3-4 years for implementation, but reformulation projects to improve nutrient profiles should start earlier to beat competitors to market with favorable labels.

2026 Planning Cycle

Technology Infrastructure Investment: Budget for traceability systems, whether building internal capabilities or contracting with third-party solutions. The requirement to provide electronic sortable spreadsheets within 24 hours means manual systems won't cut it.

Supplier Relationship Management: Traceability requires seamless data exchange with suppliers. Establish standardized formats for KDEs, clarify roles and responsibilities, and conduct trial data exchanges to identify gaps.

Comprehensive Reformulation Roadmap: Map all products containing synthetic dyes beyond Red 3. Prioritize based on sales volume, technical complexity, and competitive positioning. Plan production transitions to minimize waste of dyed ingredients.

Label Redesign Strategy: With the January 2028 uniform compliance date, plan a coordinated approach to any labeling changes finalized in 2025-2026. Include front-of-package nutrition labeling scenario planning in case that rule finalizes.

2027-2028 Implementation

Full Traceability Deployment: With the July 2028 compliance date, complete buildout of traceability systems across all relevant product lines and supply chain partners by mid-2028. Allow buffer time for testing and troubleshooting.

Synthetic Dye Elimination Completion: Ensure all reformulations are complete, validated, and in production well before applicable deadlines. Plan consumer communication strategies if sensory changes are noticeable.

Unified Labeling Compliance: Execute the January 2028 labeling transition, ensuring all affected products bear compliant labels by the deadline.

GRAS Submission Protocols: If mandatory notification rules finalize, establish internal processes for GRAS submissions including expert panel identification, data compilation, and FDA interaction management.

Building Organizational Resilience

Cross-Functional Compliance Teams: These regulations span R&D, operations, supply chain, quality, legal, and marketing. Create standing cross-functional teams with clear decision rights and escalation paths.

Regulatory Intelligence Systems: The pace and complexity of regulatory change demands systematic monitoring. Whether through external services or internal capabilities, establish reliable mechanisms to track proposed rules, comment periods, guidance documents, and enforcement actions.

Scenario Planning and Risk Assessment: Not all proposed rules will finalize as written. Develop "if/then" plans for various regulatory outcomes, with trigger points for activating different response strategies.

Budget Allocation: Compliance isn't optional, but it competes with other priorities for resources. Make the business case early for reformulation, technology, and consulting support. Compliance delays often cost more than proactive investment.

Conclusion: Preparation Is Your Competitive Advantage

2026 represents a regulatory inflection point for the food and beverage industry. The convergence of traceability requirements, labeling mandates, synthetic dye elimination, and ingredient approval pathway changes would be challenging enough individually. Together, they demand unprecedented coordination, investment, and strategic foresight.

While timeline extensions and enforcement uncertainties create temptation to delay action, the competitive advantage belongs to companies that prepare proactively. Early adopters of traceability systems will respond faster to recall situations, protecting brand reputation. Companies that reformulate ahead of synthetic dye deadlines can market their "no artificial colors" positioning before it becomes mandatory. Businesses that master the new GRAS notification process will accelerate innovation while competitors struggle with unfamiliar procedures.

The regulatory environment will continue evolving, particularly as the "Make America Healthy Again" agenda shapes FDA priorities and Congressional action influences enforcement. Participate in comment periods when rules impact your products. Engage with industry associations to shape implementation guidance. Build relationships with FDA staff who can provide compliance assistance.

Most importantly, recognize that these rules reflect genuine public health concerns and consumer demands for transparency, safety, and healthier options. Companies that view compliance as an opportunity to align with these values—rather than merely a cost to minimize—will build stronger brands and more resilient businesses.

The transformation of food regulation is underway. Your response today determines whether you lead the change or struggle to keep pace. Start planning now. Your 2028 self will thank you.

Navigating the 2026 FDA Food Regulations for Manufacturers

The regulatory landscape for food and beverage manufacturers is undergoing its most significant transformation in decades. As we move through 2026, compliance professionals face a perfect storm of new FDA requirements—from traceability mandates to artificial dye phase-outs, labeling overhauls to ingredient approval pathway changes. While some deadlines have shifted and enforcement timelines remain uncertain, the message is clear: the time to prepare is now.

For senior compliance managers, regulatory affairs professionals, and quality leaders, understanding these converging regulations isn't just about avoiding enforcement actions. It's about strategic positioning, supply chain resilience, and maintaining consumer trust in an era of unprecedented transparency. This comprehensive guide breaks down every major FDA rule change affecting your products in 2026 and beyond, with the actionable intelligence you need to stay ahead of the curve.

The Food Traceability Rule (FSMA 204): A Delayed Timeline That Still Demands Action

The most talked-about regulation in the food industry right now is undoubtedly the Food Traceability Rule under Section 204 of the Food Safety Modernization Act (FSMA 204). Originally scheduled to take effect on January 20, 2026, this rule has been at the center of intense industry lobbying, congressional action, and regulatory uncertainty.

Major Timeline Update

In a significant development, FDA has proposed to extend the compliance date for the Food Traceability Rule by 30 months to July 20, 2028. This extension provides much-needed breathing room for companies struggling to implement complex traceability systems. However, the delay should not be interpreted as permission to postpone preparation.

Adding another layer of complexity, recent fiscal year 2026 appropriations legislation includes language restricting the use of federal funds to enforce the Food Traceability Rule until its 2028 compliance date. This congressional intervention reflects the political tensions surrounding food safety modernization efforts and suggests that enforcement priorities may continue to evolve.

Understanding the Scope

The Food Traceability Rule applies to businesses that manufacture, process, pack, or hold foods on the FDA's Food Traceability List. This list includes nut butters, many varieties of produce, certain aquatic species, ready-to-eat meatless deli salads, and numerous fresh, soft cheeses—foods identified as high-risk for microbiological or chemical contamination.

The reach is broader than many companies initially realized. All restaurants and food businesses selling food and beverage totaling more than $250,000 annually will be required to provide traceability records, meaning most small and mid-sized operations fall within scope.

What You Must Track

The rule introduces new concepts that will fundamentally change how you document product movement. Every business in the supply chain must maintain records of Critical Tracking Events (CTEs) and Key Data Elements (KDEs) for listed foods.

Required information includes where the product came from, the date and location where your facility accepted the product, the traceability lot-code source information, as well as reference document information. You'll need to develop an electronic traceability plan that clearly describes your procedures for maintaining these records.

Perhaps most challenging is the speed requirement: The FDA will require organizations, including retailers, to provide an electronic sortable spreadsheet of traceability data within 24 hours of request if there is a foodborne illness outbreak or recall. This isn't about having paper files in a warehouse—it demands real-time digital systems that can rapidly retrieve and format data.

Records must be kept for at least two years, and the level of detail required goes beyond traditional lot tracking. You'll need to document how food was sourced, stored, and modified at each step, including temperature data during shipping, freshness dates, and storage conditions.

Technology Infrastructure Requirements

The complexity of these requirements is driving many companies toward third-party technology solutions. Companies typically use their GS1 Global Trade Item Numbers (GTINs) and an internal lot code to create their Traceability Lot Code. You'll also need a Traceability Lot Code Source that includes either a physical address or an FDA Food Facility Registration Number.

Despite the extended timeline, start building your traceability infrastructure now. Supply chain partners need time to align their systems with yours, and testing data exchange protocols across multiple tiers of suppliers can reveal unexpected gaps that require months to resolve.

Front-of-Package Nutrition Labeling: The Nutrition Info Box

FDA is proposing one of the most visible changes to packaged food in decades: mandatory front-of-package nutrition labeling that would fundamentally alter how consumers evaluate your products at shelf.

The Proposed Nutrition Info Box

In January 2025, FDA published a proposed rule requiring food manufacturers to display a front-of-package nutrition label on most packaged foods, showing saturated fat, sodium and added sugars content with "Low," "Med" or "High" level indicators. This "Nutrition Info box" would appear on the principal display panel—your product's front face—not tucked away on the back panel like the Nutrition Facts label.

The proposal targets the three nutrients most directly linked to chronic diseases when consumed in excess: saturated fat, sodium, and added sugars. FDA's research, including an experimental study of nearly 10,000 U.S. adults, showed that interpretive labels with simplified schemes help consumers make healthier choices more easily.

FDA extended the comment period for the proposed rule until July 15, 2025, acknowledging the far-reaching implications for packaging design, reformulation strategies, and competitive positioning.

Timeline and Compliance Requirements

If finalized as proposed, the rule would establish a compliance date of three years after the final rule's effective date for businesses with $10 million or more in annual food sales, and four years for businesses with less than $10 million. This means we're realistically looking at 2028-2029 implementation for most companies—but planning must begin immediately.

The packaging implications alone are substantial. Every product face must accommodate a standardized box with nutrient information and interpretive language. For products with limited principal display panel space, this could necessitate complete package redesigns, affecting everything from brand presentation to structural packaging formats.

Strategic Considerations

This rule creates both risks and opportunities. Products currently perceived as indulgent treats may face "High" designations across multiple nutrients, potentially impacting sales. Conversely, products that can claim "Low" across the board gain a powerful new marketing tool.

Reformulation becomes a strategic weapon. Companies willing to invest in reducing saturated fat, sodium, or added sugars can differentiate themselves with favorable front-of-package designations. But reformulation without compromising taste, texture, or shelf life requires significant R&D investment and time—often 18-24 months for complex products.

The competitive landscape will shift. Smaller brands that have built their positioning around "cleaner" ingredient profiles may find themselves with inherent advantages, while established brands with legacy formulations face difficult choices about whether to reformulate iconic products or accept less favorable labeling.

Artificial Food Dye Phase-Out: Red 3 Ban and Beyond

The era of petroleum-based synthetic food dyes is ending, with immediate compliance deadlines and broader industry transformation underway.

Red Dye No. 3: Definitive Timelines

On January 15, 2025, FDA issued an order to revoke authorization for FD&C Red No. 3 in food and ingested drugs, with manufacturers having until January 15, 2027 for food products and January 18, 2028 for drugs to reformulate. This cherry-red dye, used primarily in candy, cakes, cookies, frozen desserts, and frostings, has been banned in cosmetics since 1990 due to cancer concerns in animal studies.

The Red 3 ban is mandatory and enforceable. Unlike some other rules we've discussed, this one has clear statutory authority under the Delaney Clause, which prohibits color additives found to cause cancer in animals. There's no ambiguity here—if your products contain Red 3, you must reformulate or face enforcement action.

The Broader Synthetic Dye Elimination

Red 3 is just the beginning. HHS Secretary Kennedy announced in April 2025 that FDA is working with industry to eliminate six remaining synthetic dyes on the U.S. market—Green 3, Red 40, Yellow 5, Yellow 6, Blue 1, and Blue 2—by the end of 2026. Additionally, FDA has requested that food companies remove Red 3 from their products sooner than the current 2027-2028 deadlines.

This broader phase-out relies primarily on voluntary industry cooperation rather than regulatory mandate, creating uncertainty about timing and enforcement. The plan has been criticized for lacking specifics about what actions FDA will take if companies fail to comply by end of 2026.

Products and Categories Affected

The impact spans virtually every category of processed food and beverage. Red 40 is ubiquitous in sodas, candy, and desserts. Yellow 5 appears in cereals, chips, and flavored drinks. Yellow 6 is used in baked goods, gelatin, and sauces. Blue 1 and Blue 2 color candy coatings, frostings, and beverages. These dyes have been industry staples for decades because of their low cost, bright appearance, and stability.

Reformulating without these workhorses is non-trivial. Natural alternatives exist—beet juice for reds, turmeric for yellows, spirulina for blues, annatto for oranges, butterfly pea flower for purples—but they behave differently. Natural colors can fade with light exposure, shift with pH changes, and require higher usage rates to achieve comparable vibrancy. They're also typically more expensive.

Implementation Strategy

Start reformulation projects now, even for dyes beyond Red 3. The 2026-2027 timeframe is aggressive for complex product portfolios. You'll need to:

Audit all SKUs for synthetic dye usage

Identify natural alternatives that maintain sensory characteristics

Conduct stability testing across shelf life

Validate that natural alternatives don't create new allergens or labeling issues

Plan production transitions and label updates

Communicate changes to consumers who may notice color differences

Budget constraints and recent FDA staff cuts may slow the agency's ability to deliver on synthetic dye elimination timelines, but consumer pressure and state-level bans (like California's restrictions) mean the market is moving regardless of federal enforcement.

GRAS Self-Affirmation Pathway: Major Changes Coming

The Generally Recognized as Safe (GRAS) system—the pathway by which food ingredients are deemed safe for use—is undergoing its most significant overhaul in decades, with profound implications for innovation and product development.

The Proposed Mandatory Notification Rule

FDA added to its spring 2026 agenda a proposed rule requiring mandatory submission of GRAS notices for the use of human and animal food substances. This follows HHS Secretary Kennedy's March 2025 directive to the FDA to explore potential rulemaking to eliminate the self-affirmed GRAS pathway.

Currently, companies can determine an ingredient is GRAS through independent expert panel review without notifying FDA—the self-affirmation pathway. Alternatively, they can voluntarily submit a GRAS notice to FDA for review. The FDA evaluates approximately 75 GRAS notices per year and has completed and published more than 1,000 notices in its public inventory.

The proposed rule would eliminate self-affirmation, requiring all companies to notify FDA before introducing new ingredients. This represents a fundamental shift from a system where FDA oversight is encouraged but optional to one where it's mandatory.

What Changes for Your Ingredient Strategy

The practical implications are substantial. Currently, self-affirmation offers a faster, more confidential pathway to market. Companies can convene expert panels, assess safety data, and proceed without public disclosure of proprietary information or trade secrets. The typical FDA GRAS notification process takes 160+ days on average, and that timeline could extend significantly if notification becomes mandatory and submission volume increases.

Under the proposed rule, substances already listed as GRAS by regulation or that have received a "no questions" letter would be exempted. But any new ingredient not yet determined as GRAS would face mandatory FDA review.

The Innovation Impact

Industry experts warn of a "chilling effect" on ingredient innovation. The self-affirmation pathway has enabled smaller companies and startups to introduce novel ingredients without the resource requirements of full FDA submissions. It has also allowed incremental improvements to existing ingredients—slight modifications to manufacturing processes or formulations—without triggering formal FDA review.

If mandatory notification becomes reality, expect:

Longer development timelines for products using new ingredients

Higher costs for ingredient approval

Potential FDA backlog as submission volume increases

Rush to self-affirm ingredients currently in development before the rule takes effect

Reduced ingredient innovation, particularly from smaller suppliers

The rule is still in proposed form, with rulemaking typically taking several years. However, companies with ingredients in development should consider pursuing self-affirmation now, before the window closes. Once on the GRAS inventory with a "no questions" letter, those ingredients would be grandfathered under the new system.

Plant-Based Milk Alternative Labeling: Draft Guidance Creates New Compliance Questions

The long-running dispute over whether plant-based products can use dairy terminology has resulted in FDA guidance that attempts to split the difference—but may create as many questions as it answers.

Naming Conventions and the "Milk" Debate

FDA's February 2023 draft guidance confirms that common or usual names of some plant-based milk alternatives, such as "soy milk" and "almond milk," have been established by common usage. This was a significant acknowledgment that consumers understand these products are not dairy milk and choose them precisely because they are plant-based alternatives.

However, FDA didn't stop there. The guidance includes a recommendation that may prove more burdensome than the naming question itself.

Voluntary Nutrient Statements

FDA recommends that plant-based milk alternative products labeled with "milk" in their names, such as "soy milk" or "almond milk," and that have a nutrient composition different than milk, include a voluntary nutrient statement on the product label describing how it is nutritionally different, such as "Contains lower amounts of Vitamin D and calcium than milk".

This comparison is based on USDA's Food and Nutrition Service fluid milk substitutes nutrient criteria, which includes nine nutrients: calcium, protein, vitamin A, vitamin D, magnesium, phosphorous, potassium, riboflavin, and vitamin B12.

The statement should appear on the principal display panel—the front of the package—making this a significant packaging and positioning consideration.

The "Voluntary" Problem

Here's where it gets tricky: the guidance is technically voluntary and non-binding. However, legal experts note that draft guidance creates potential liability exposure. Companies that choose to ignore FDA's recommendations may find themselves targets of class action lawsuits claiming their labeling is misleading or fails to follow FDA guidance.

In practice, "voluntary" FDA guidance often becomes de facto mandatory because the litigation risk of non-compliance outweighs the benefit of ignoring it.

Strategic Positioning Challenges

The nutrient statement requirement puts plant-based milk brands in an uncomfortable position. They must either:

Add front-of-package text highlighting nutritional deficiencies compared to dairy milk

Stop using "milk" in the product name and switch to terms like "beverage" or "drink"

Ignore the guidance and accept potential litigation risk

Many plant-based brands built their market position specifically on the "milk" terminology that consumers understand and search for. Switching to "beverage" would create marketing challenges and consumer confusion. But adding statements about lower calcium or protein creates negative framing at the exact moment of purchase decision.

The dairy industry, meanwhile, continues to push for stricter enforcement of standards of identity that would prohibit "milk" terminology entirely on non-dairy products, making this guidance potentially just one chapter in an ongoing regulatory battle.

Sesame Allergen Requirements: Compliance Continues to Evolve

While sesame became the ninth major food allergen effective January 1, 2023, the implementation continues to create challenges and evolve through 2026.

The Ongoing Transition

Sesame is required to be labeled as an allergen on packaged foods, including dietary supplements, as of January 1, 2023. However, because products manufactured before 2023 were not required to be removed from the marketplace, some products without sesame allergen labeling may still be found on store shelves, particularly canned and frozen foods with longer shelf lives.

The bigger issue has been an unintended consequence of the allergen designation: some manufacturers began intentionally adding sesame to products that previously didn't contain it, rather than implementing controls to prevent cross-contact. This technically kept them in compliance with allergen disclosure requirements but reduced options for sesame-allergic consumers.

FDA updated its draft guidance in 2023 to address food manufacturers circumventing allergen cross-contact requirements by intentionally adding sesame to products, denouncing this practice as limiting options for consumers with sesame allergies.

Chapter 11: Food Allergen Program

FDA's updated guidance includes a new chapter on establishing and implementing food allergen programs. This provides specific examples of ways to significantly minimize or prevent allergen cross-contact using current good manufacturing practices and preventive controls.

The guidance emphasizes that labeling errors cause most FDA food allergen recalls. It includes recommendations for monitoring and verifying that allergens are properly declared and correct labels are used. For situations where, despite appropriate controls, allergen cross-contact cannot be completely avoided, FDA discusses options including voluntary allergen advisory statements.

2026 Compliance Priorities

For sesame allergen management in 2026:

Review your allergen control programs to ensure robust cross-contact prevention

Verify that sesame is properly identified when present as part of other ingredients like "natural flavor" or "spice mix"

If using "Contains" statements, ensure sesame is included when present

Train employees on all nine major food allergens (sesame is frequently overlooked as the newest addition)

Document your allergen program and controls in writing

Uniform Compliance Date for Food Labeling: Coordinated Planning Opportunity