Jan 26, 2026

Articles

Jan 26, 2026

Articles

Jan 26, 2026

Articles

Mastering Cosmetics Formula Validation: Key Steps and Best Practices

Martín Ramírez

Martín Ramírez

Martín Ramírez

Introduction

The global cosmetics industry stands as a testament to human ingenuity and the relentless pursuit of beauty, wellness, and self-expression. Surpassing $430 billion in annual value, this market is vast and fiercely competitive, driven by rapid innovation and ever-evolving consumer expectations. Yet, beneath the surface of every new product launch—whether a cutting-edge serum, a vibrant lipstick, or a gentle cleanser—lies a rigorous, often invisible process: formula validation.

Formula validation is the systematic, science-driven discipline that ensures every cosmetic product’s composition meets a complex web of regulatory requirements, safety standards, and brand-specific criteria before it ever reaches the market. This process is not a mere checkbox on a project plan; it is the critical gatekeeper that protects consumers, preserves brand reputations, and enables global market access. The stakes are extraordinarily high. A single non-compliant product can trigger recalls costing tens of millions of dollars, inflict lasting reputational damage, and, most importantly, put consumer health at risk.

The regulatory landscape for cosmetics is evolving at an unprecedented pace. In the United States, the Modernization of Cosmetics Regulation Act (MoCRA) has ushered in the most significant overhaul of cosmetic regulations in decades, raising the bar for safety substantiation, ingredient disclosure, and adverse event reporting. Meanwhile, the European Union continues to refine its already stringent requirements, demanding exhaustive documentation and proactive compliance. These changes have elevated expectations for brands and manufacturers, making formula validation more complex and essential than ever before.

The validation process itself is multifaceted and demanding. It involves a comprehensive review of each ingredient for compliance with regional bans, restrictions, and permitted concentrations. Safety assessments evaluate exposure levels and toxicological profiles, while impurity screenings ensure raw materials are free of harmful contaminants. Claims made on packaging must be substantiated by the formula, and labels must accurately reflect all ingredients and mandatory warnings. Each of these steps is critical, as even minor errors or omissions can cascade through the supply chain, affecting not only brands but also manufacturers, retailers, and ultimately, consumers.

Despite its importance, formula validation remains a largely manual process in many organizations. Regulatory professionals often find themselves buried in spreadsheets, chasing down missing documentation from suppliers, and interpreting ever-changing regulations across multiple markets. This environment is ripe for human error—whether it’s a missed regulatory update, a copy-paste mistake, or an overlooked allergen. The consequences of such errors can be severe, ranging from costly recalls and delayed product launches to legal exposure and erosion of consumer trust.

This article will take you through the end-to-end process of formula validation, shedding light on where errors and omissions most commonly occur and examining the profound impact they can have on all stakeholders in the supply chain. We will explore the true costs of manual compliance, from direct labor and external consulting fees to the hidden toll of near-misses and lost market opportunities. The discussion will also map the global regulatory landscape, illustrating the complexity of achieving compliance across divergent regions and the unique challenges this presents.

Most importantly, we will examine how artificial intelligence is revolutionizing formula validation. AI-powered platforms can now cross-reference formulas against regulatory databases in real time, automate repetitive checks, and provide instant feedback to formulators. This transformation is not about replacing human expertise, but about augmenting it—freeing professionals to focus on strategic decision-making and innovation while ensuring the highest standards of safety and compliance.

In a world where regulatory expectations are only intensifying, organizations that embrace modern, AI-enabled compliance programs will not only protect consumers and preserve their reputations but also gain a decisive competitive edge. The time to evaluate and modernize your formula validation process is now—because in today’s market, compliance is not just a requirement; it is a strategic advantage that can define the future of your brand.

Section 1: What Is Cosmetics Formula Validation?

Cosmetics formula validation is the systematic process of verifying that a product’s composition aligns with all applicable regulatory requirements, safety thresholds, and internal brand standards before it is manufactured at scale or introduced to the market. This discipline is foundational to the responsible development and commercialization of cosmetic products, serving as the bridge between innovation and safe, compliant consumer offerings.

Defining Formula Validation

At its core, formula validation is a comprehensive review of a cosmetic formula's quantitative and qualitative aspects. This review is conducted against a backdrop of complex, often overlapping regulations that vary by country and region. The process is distinct from other critical steps in product development, such as formula development (where the actual product is conceived and iterated), stability testing (which ensures the product maintains its integrity over time), and clinical testing (which may assess efficacy or skin compatibility). Formula validation is the gatekeeper that determines whether a product is ready for manufacturing scale-up and market entry.

The validation process is methodical and data-driven. It begins with a detailed examination of every ingredient in the formula, including their International Nomenclature of Cosmetic Ingredients (INCI) names, concentrations, and sources. Each ingredient is cross-referenced against regulatory databases to ensure it is permitted for use in the target market and that its concentration does not exceed legal limits. This step is crucial, as regulations can differ dramatically between regions—an ingredient allowed in the United States may be restricted or banned in the European Union, and vice versa.

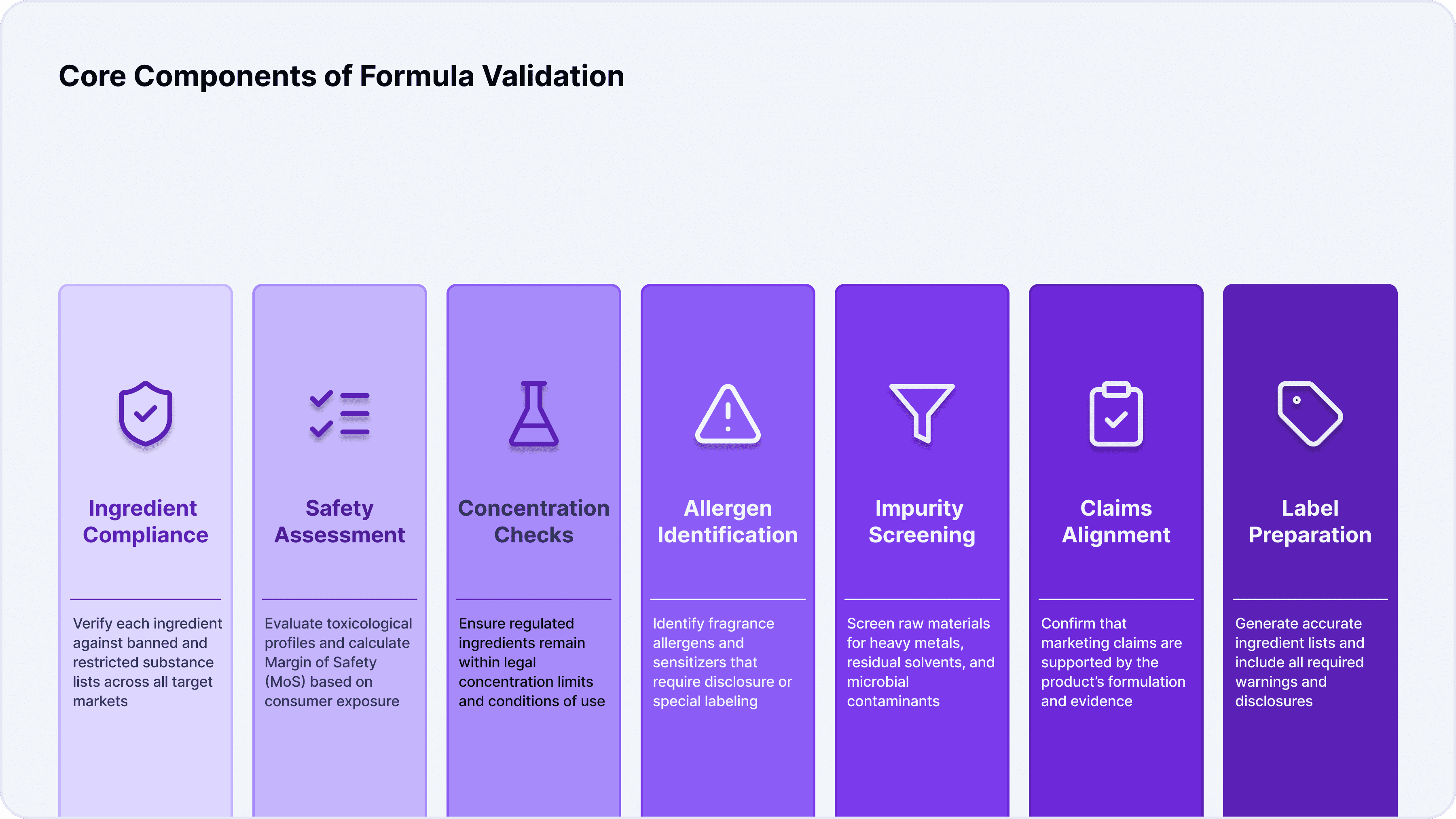

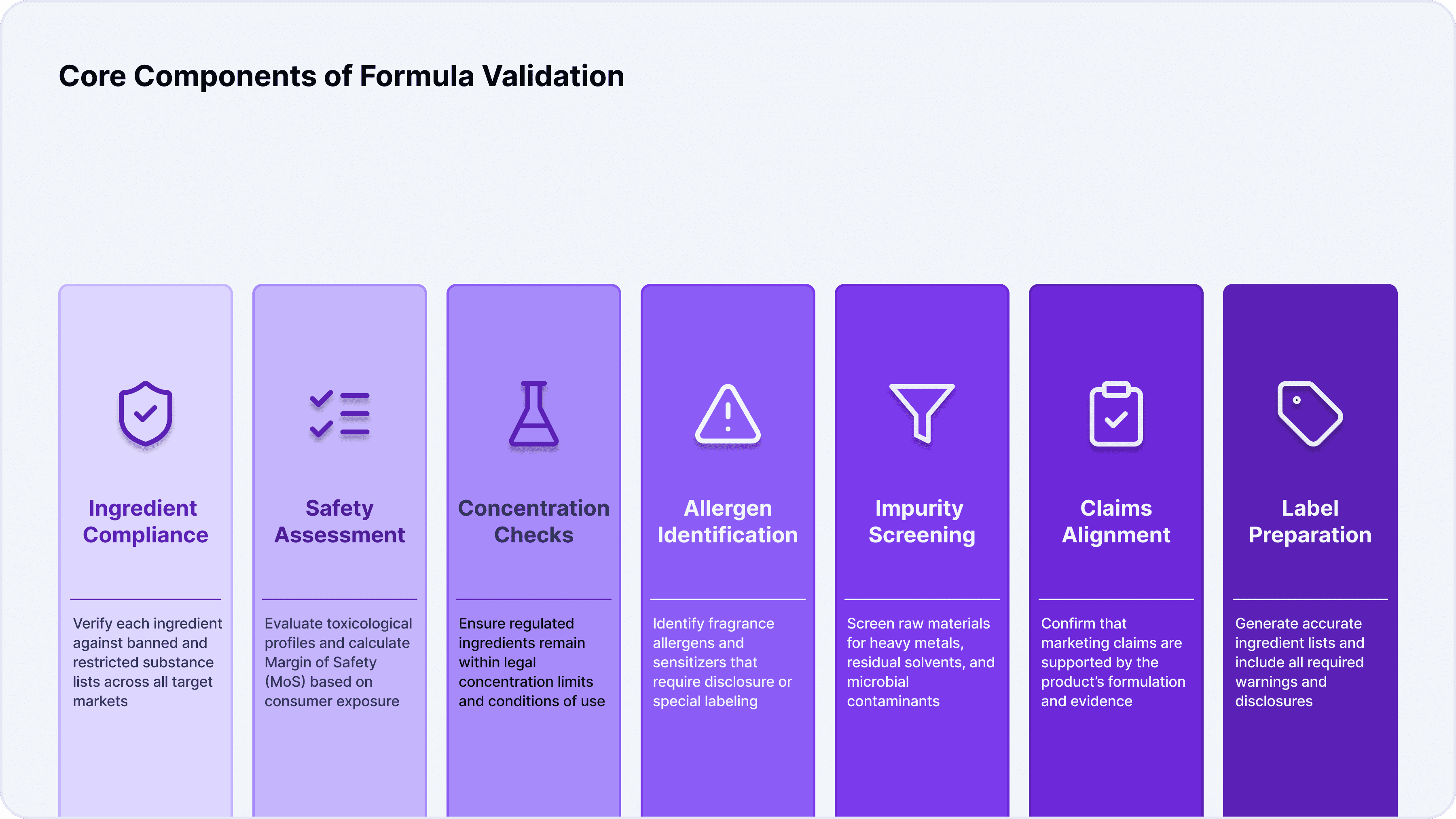

Core Components of Formula Validation

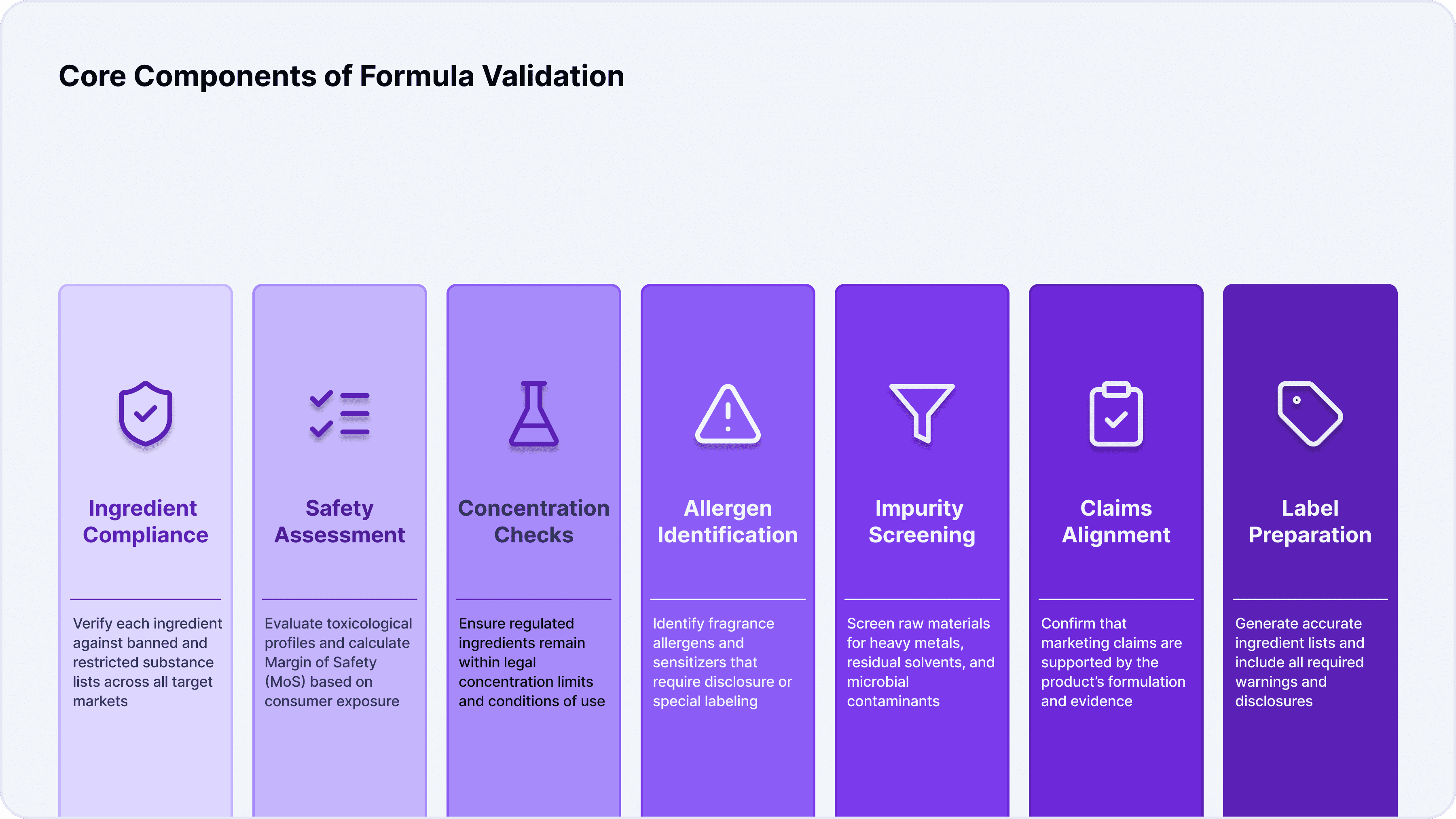

Ingredient Compliance: The first pillar of formula validation is ingredient compliance. This involves checking each INCI ingredient against lists of banned and restricted substances and verifying that permitted ingredients are used within allowable concentrations. Regulatory authorities such as the EU (via Regulation 1223/2009), the US FDA, Health Canada, and others maintain extensive annexes and hotlists that must be meticulously consulted.

Safety Assessment: Beyond regulatory compliance, formula validation requires a robust safety assessment. This typically involves calculating the Margin of Safety (MoS) for each ingredient based on expected exposure levels, reviewing toxicological profiles, and assessing cumulative exposure from multiple sources. The goal is to ensure that the product is not only legally compliant but also safe for its intended use and user population.

Concentration Checks: Certain classes of ingredients—such as preservatives, UV filters, colorants, and fragrances—are subject to strict concentration limits. Formula validation ensures that these substances are present within legal thresholds and that any conditions of use (such as rinse-off versus leave-on) are properly accounted for.

Allergen Identification: Fragrance allergens and sensitizers are a particular focus, as they can pose significant risks to sensitive individuals. Validation includes identifying any substances that require labeling under regional regulations and ensuring that consumers are adequately informed.

Impurity Screening: Raw materials can contain impurities such as heavy metals, residual solvents, or microbial contaminants. Formula validation includes screening for these impurities and verifying that their levels are within the permissible limits defined by regulatory authorities.

Claims Alignment: The claims made on product packaging—whether “hypoallergenic,” “dermatologist-tested,” or “anti-aging”—must be substantiated by the formula itself. Validation ensures that claims are supported by the product’s composition and do not cross into territory regulated as drugs or therapeutic goods.

Label Preparation: Finally, formula validation supports the preparation of accurate ingredient lists and the inclusion of mandatory warnings on product labels. This step is critical for both regulatory compliance and consumer transparency.

Why Formula Validation Is Not Optional

The necessity of formula validation is underscored by the demands of regulatory authorities, retailers, and consumers alike. In the United States, the FDA (under MoCRA), Health Canada, and EU authorities require documented evidence of product safety and compliance. Retailers increasingly demand proof of compliance before listing products, and contract manufacturers require validated formulas to mitigate their own risk. Meanwhile, consumer and advocacy group scrutiny is at an all-time high, with social media amplifying the consequences of any misstep.

In short, formula validation is not a bureaucratic formality—it is an essential discipline that underpins the safety, legality, and success of every cosmetic product in the global marketplace.

Section 2: The Manual Formula Validation Process

Despite the critical importance of formula validation, many organizations still rely on manual processes that are time-consuming, error-prone, and difficult to scale. Understanding the traditional, manual approach to formula validation is essential for appreciating both its limitations and the transformative potential of modern, AI-driven solutions.

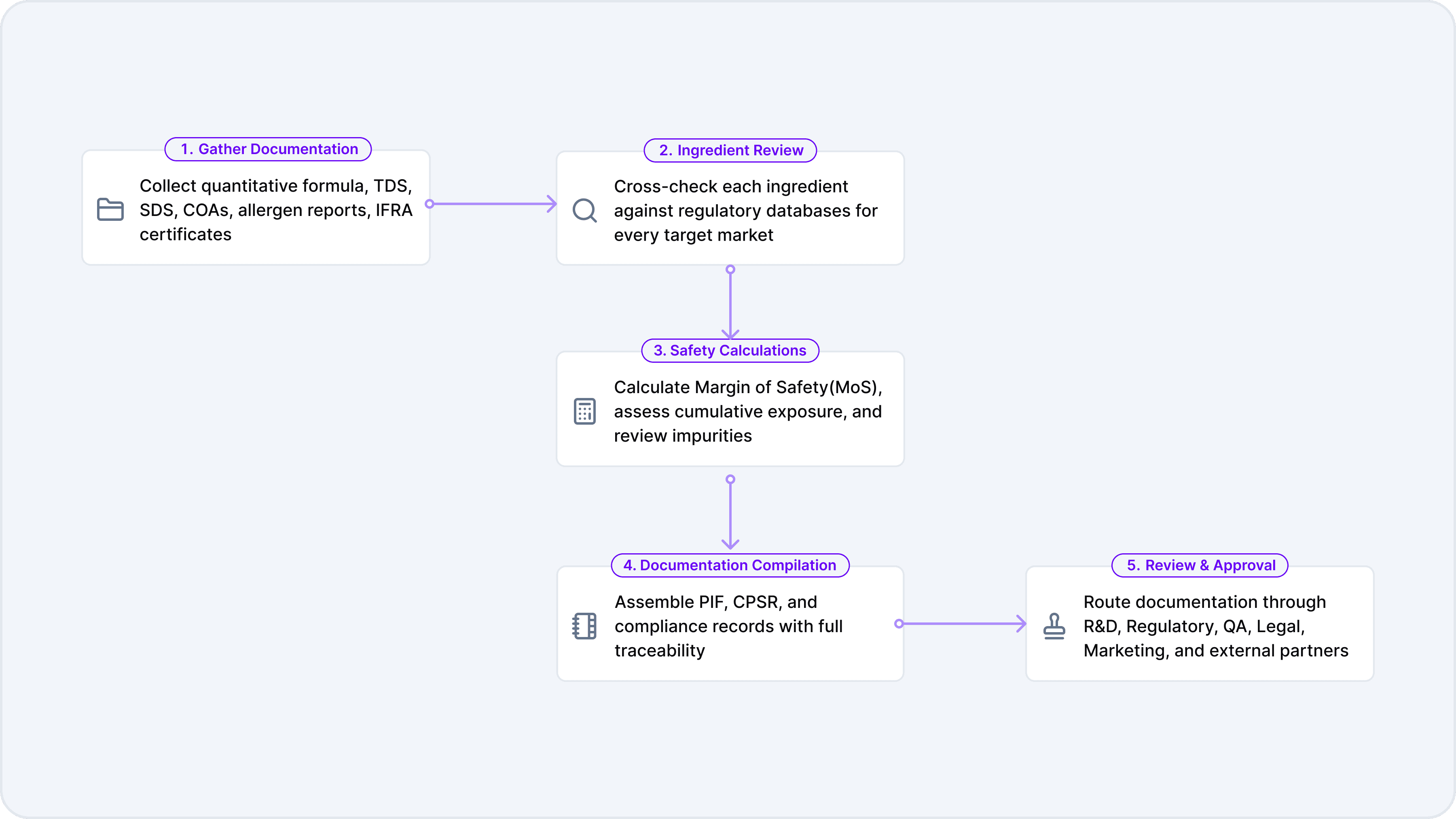

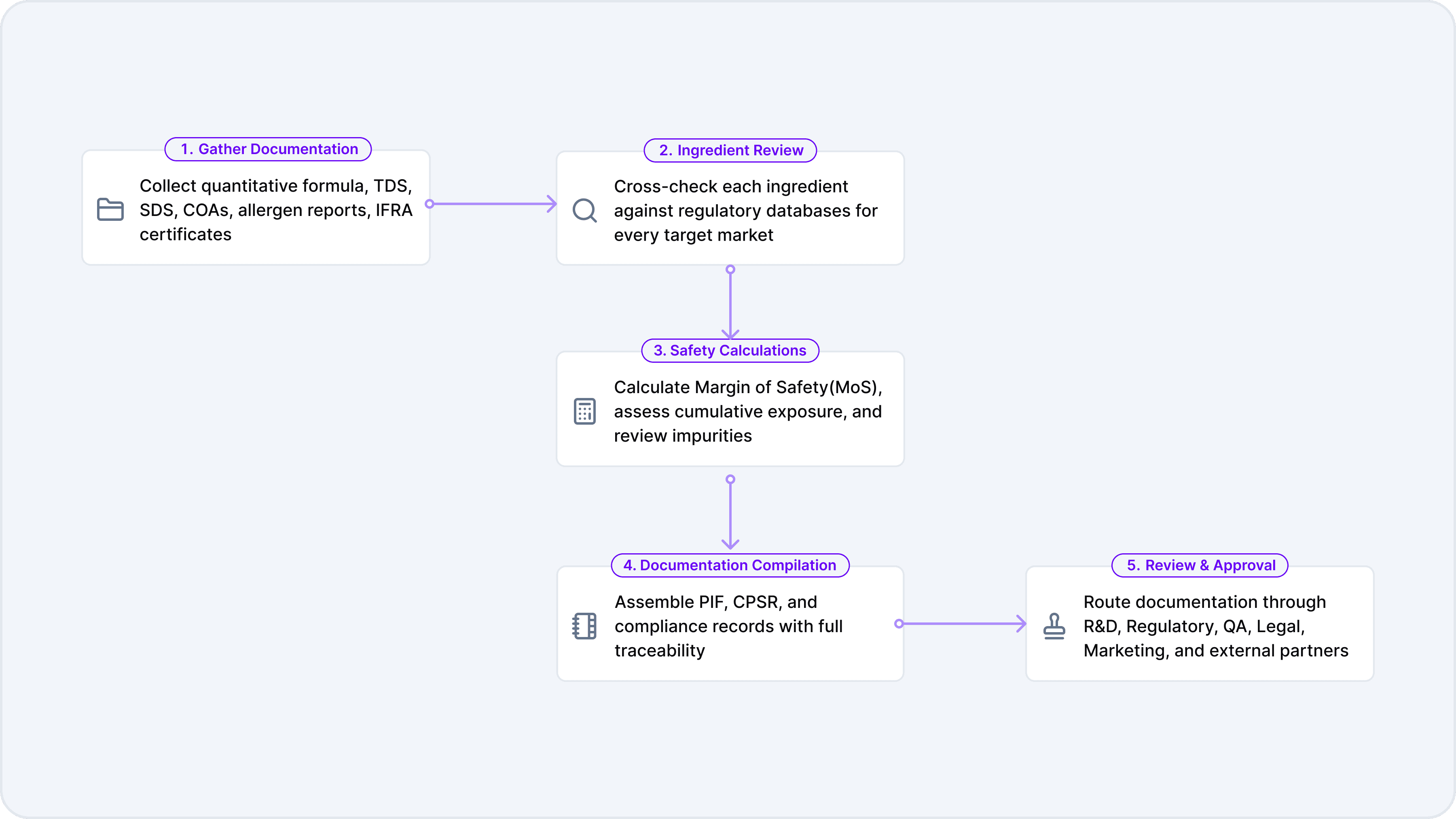

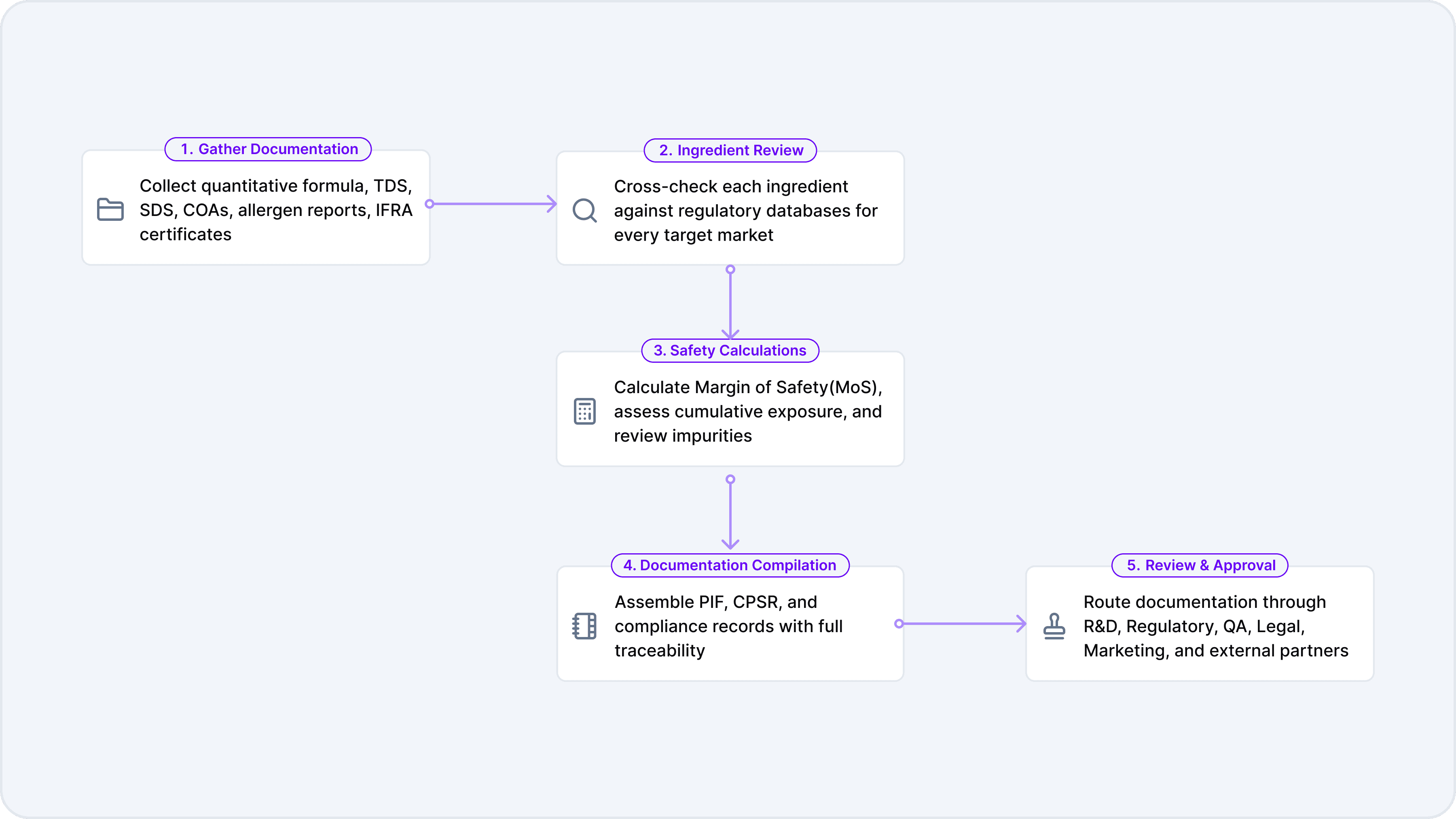

Step 1: Gathering Documentation

The manual validation process begins with the collection of extensive documentation. This includes the quantitative formula (detailing every ingredient and its concentration), Technical Data Sheets (TDS), Safety Data Sheets (SDS), Certificates of Analysis (CoA), allergen reports, and International Fragrance Association (IFRA) certificates. Each document provides critical information for assessing compliance and safety.

However, gathering this documentation is rarely straightforward. Suppliers may take days or even weeks to provide the necessary documents, and version control can quickly become a challenge as formulations are updated or revised. Regulatory professionals often find themselves chasing down missing documents, reconciling conflicting information, and managing multiple versions of the same file. This step alone can consume a significant portion of the validation timeline.

Step 2: Ingredient-by-Ingredient Review

Once the documentation is in hand, the next step is a painstaking, ingredient-by-ingredient review. Each ingredient must be cross-referenced against regulatory databases for every target market. In the European Union, this means consulting Regulation 1223/2009 and its annexes, which list prohibited and restricted substances, permitted colorants, preservatives, and UV filters. In the United States, the review must account for FDA regulations, state-level requirements such as California’s Proposition 65, and the new demands of MoCRA. Other markets, such as ASEAN, China (IECIC), and Health Canada (Hotlist), each have their own unique requirements.

This process is labor-intensive and requires a deep understanding of both the regulations and the nuances of each ingredient. Some ingredients may be permitted in one market but restricted or banned in another. Others may be subject to specific conditions of use, such as maximum concentrations or limitations on product type (e.g., rinse-off vs. leave-on). Each ingredient may require checking multiple lists and interpreting complex regulatory language.

Step 3: Safety Calculations

With ingredient compliance established, the next step is to conduct safety calculations. This typically involves calculating the Margin of Safety (MoS) for each ingredient, based on expected exposure levels and toxicological data. The MoS is a critical metric that helps determine whether an ingredient is safe for use at the intended concentration and in the intended product type.

Safety assessments also include a review of cumulative exposure, particularly for ingredients that may be present in multiple products used by the same consumer. Impurity levels must be checked against regulatory limits, and any potential interactions between ingredients must be considered. This step requires both scientific expertise and meticulous attention to detail.

Step 4: Documentation Compilation

Once the safety assessment is complete, the next step is to compile the necessary documentation to support regulatory submissions and internal approvals. In the European Union, this means assembling the Product Information File (PIF), which includes the Cosmetic Product Safety Report (CPSR), ingredient lists, and supporting data. In the United States, documentation must substantiate safety under MoCRA and be available for FDA inspection.

Traceability is essential at this stage. Every decision must be linked to its source, whether a regulatory database, supplier document, or scientific study. Version control and audit trails are critical to ensure that the documentation is accurate, up-to-date, and defensible in the event of an audit or recall.

Step 5: Review and Approval Cycles

The final step in the manual validation process is the review and approval cycle. The compiled documentation is routed through multiple stakeholders, including R&D, regulatory affairs, quality assurance, legal, and marketing. Each group may have its own requirements and perspectives, leading to multiple rounds of revisions and feedback.

Coordination with external partners—such as contract manufacturers, consultants, and testing laboratories—adds another layer of complexity. Final sign-off is required before the product can proceed to manufacturing and market launch.

Timeline Reality

The manual validation process is time-consuming and resource-intensive. For a single formula targeting a single market, the process can take two to four weeks. If the product is intended for multiple markets, the effort multiplies, as each market’s requirements must be addressed separately. Any reformulation—whether to address a compliance issue, improve performance, or respond to supply chain disruptions—restarts the process, adding further delays.

In today’s fast-paced, trend-driven market, these timelines can be a significant barrier to innovation and competitiveness. The manual process, while thorough, is increasingly unsustainable amid growing complexity and accelerating regulatory change.

Section 3: Where Errors and Omissions Occur

Even the most diligent manual validation processes are vulnerable to errors and omissions. The complexity of the regulatory landscape, the volume of documentation, and the reliance on human interpretation create numerous opportunities for mistakes—many of which can have serious consequences.

Human Error

Human error is an unavoidable reality in manual validation. According to industry surveys, 42% of regulatory professionals report having missed at least one requirement during formula validation. The sources of these errors are manifold: spreadsheet mistakes, copy-paste errors, outdated data, and simple fatigue. The sheer volume of information that must be processed—often under tight deadlines—makes it easy for even experienced professionals to overlook critical details.

Inconsistent interpretation of regulations is another common issue. Regulatory language can be ambiguous, and team members may interpret the same requirement differently. This can lead to inconsistent application of rules and, ultimately, non-compliance.

Outdated Information

Regulations governing cosmetics are in constant flux. New ingredients are added to banned lists, concentration limits are revised, and labeling requirements are updated. Manual tracking of these changes across multiple jurisdictions is virtually impossible in real time. As a result, 38% of regulatory professionals admit they may be unaware of critical updates affecting their products.

There is often a lag between the publication of new regulations and their incorporation into internal databases and processes. This creates a risk window during which products may be validated against outdated requirements, exposing the company to compliance failures.

Documentation Gaps

Supplier documentation is the foundation of formula validation, but it is not always complete or reliable. Missing or incomplete Technical Data Sheets, inconsistent quality of Safety Data Sheets, and failure to verify supplier claims are common challenges. Version mismatches—where the documentation does not match the current formula—can lead to incorrect assessments and missed requirements.

The reliance on external partners for documentation adds another layer of complexity. Suppliers may be slow to respond, provide outdated information, or lack the expertise to ensure their documentation meets regulatory standards.

Communication Breakdowns

Formula validation is a cross-functional process that requires coordination between multiple teams and external partners. In many organizations, communication is managed through email-based feedback loops, shared spreadsheets, and ad hoc meetings. This approach is prone to breakdowns: context is lost over time, feedback is overlooked, and critical information falls through the cracks.

Siloed processes further exacerbate the problem. When teams operate independently, there is a risk that important decisions and updates are not communicated effectively, leading to inconsistent or incomplete validation.

Calculation Mistakes

Safety calculations—such as Margin of Safety assessments—are complex and require precise data and careful interpretation. Errors in these calculations can result from incorrect input data, misinterpretation of conditions of use, or incorrect product categorization. Cumulative exposure assessments, which require consideration of multiple products and use scenarios, are particularly challenging.

These mistakes can have serious consequences, as they may lead to the approval of unsafe products or the unnecessary rejection of compliant formulas.

Hidden Costs of Near-Misses

Not all errors result in immediate compliance failures. Many are caught late in the process—during final review, external audits, or even after market launch. These near-misses can delay product launches, consume valuable resources in rework, and erode confidence in the validation process. Unfortunately, near-misses are rarely documented or analyzed, preventing organizations from learning from their mistakes and improving their processes.

The cumulative impact of these errors and omissions is significant. They not only increase the risk of compliance failures but also drive up costs, delay innovation, and strain relationships across the supply chain.

Section 4: The True Cost of Manual Compliance

The costs associated with manual formula validation extend far beyond the direct labor required to complete the process. They encompass opportunity costs, external fees, technology investments, and the potentially devastating consequences of errors and recalls. Understanding the full scope of these costs is essential for making informed decisions about process improvement and technology adoption.

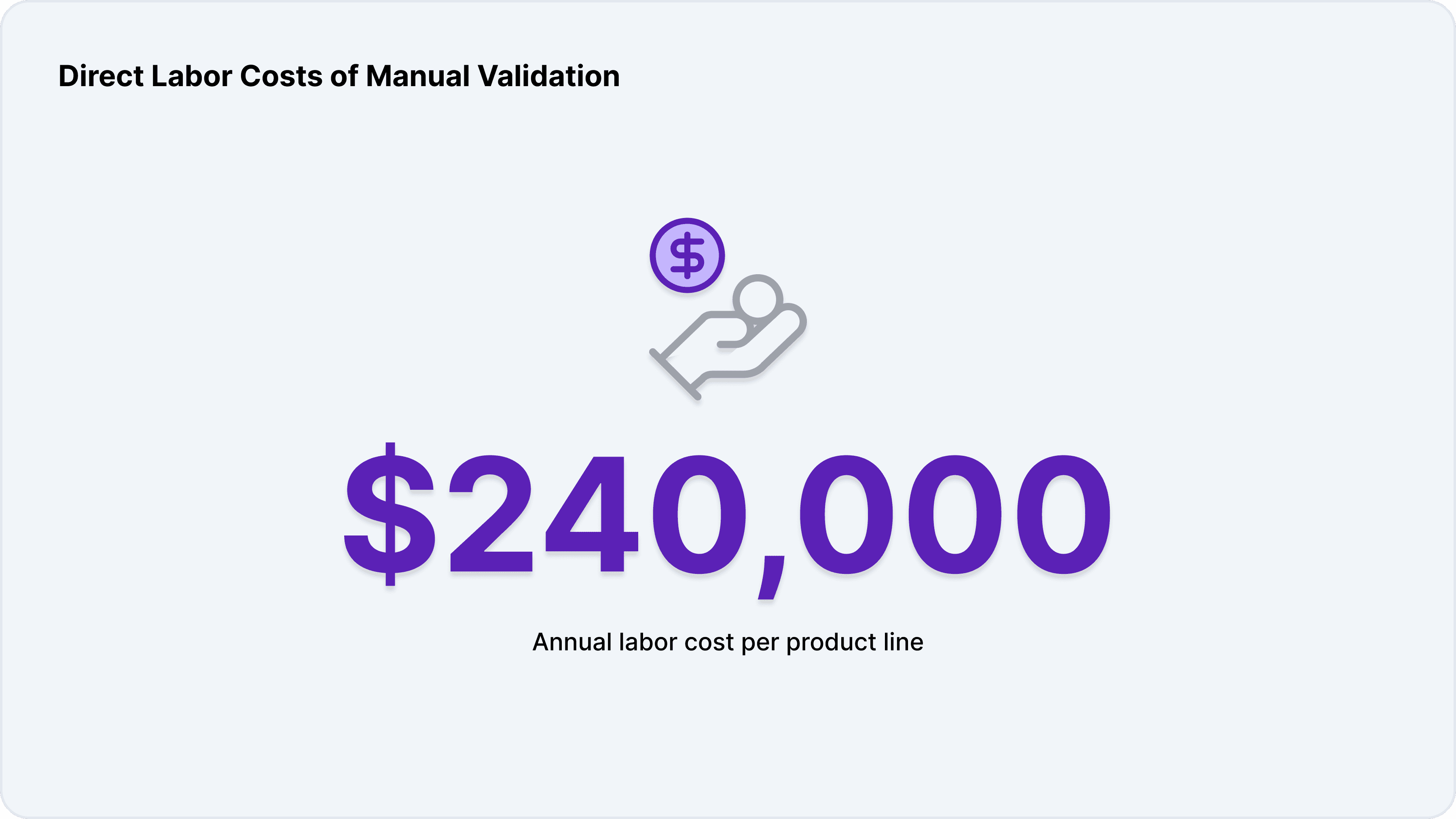

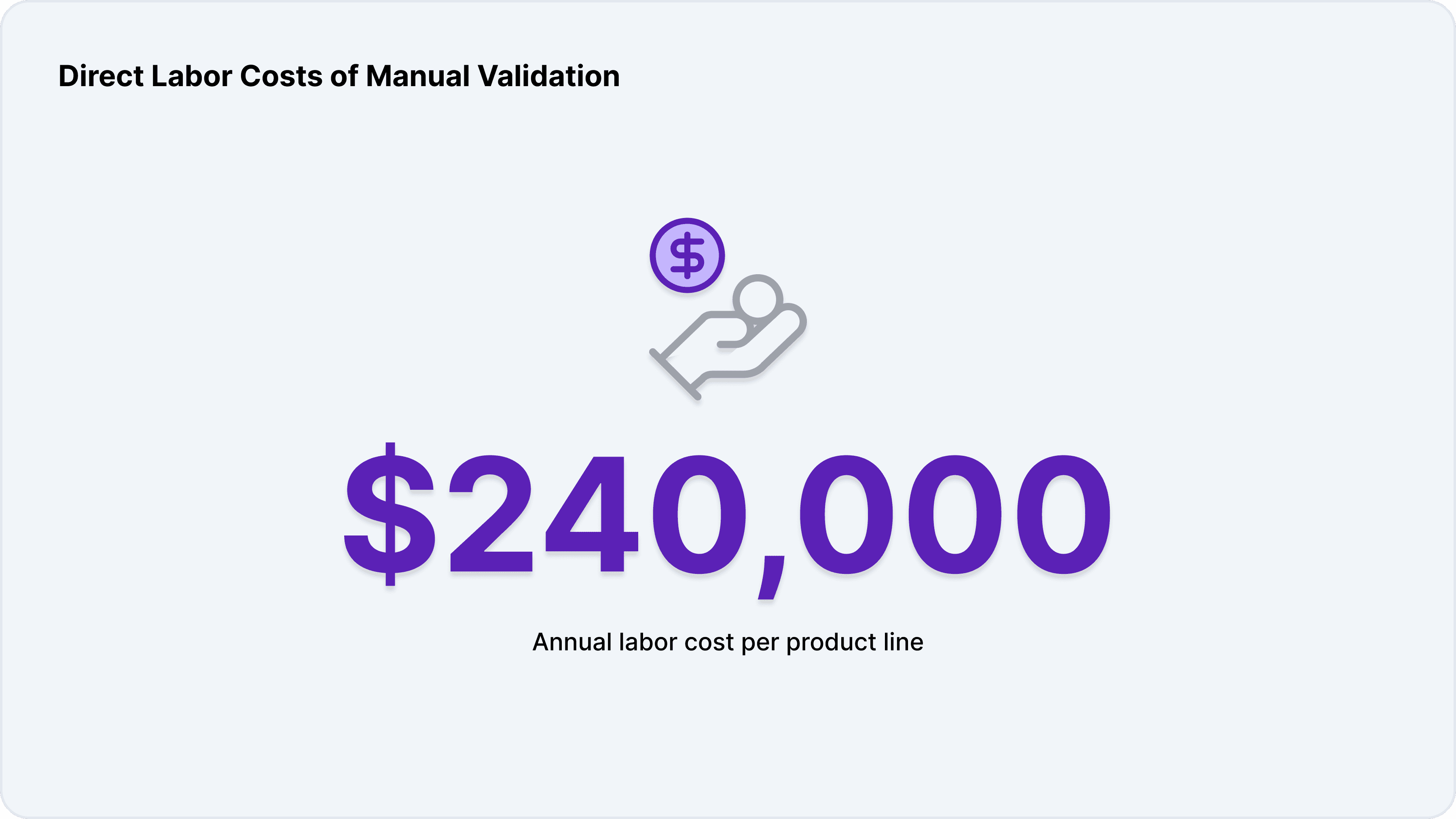

Direct Labor Costs

Manual formula validation is labor-intensive. Regulatory teams spend an estimated 40% of their workweek researching regulations, gathering documentation, and conducting ingredient reviews. For a small compliance team, this can translate to approximately $240,000 in annual labor costs. Larger organizations, with more products and markets to manage, can see these costs multiply rapidly.

These labor costs are not just a function of the number of products but also the complexity of each formula and the number of markets targeted. Multi-market launches require separate validations for each jurisdiction, further increasing the workload.

Opportunity Costs

Compliance delays are a leading cause of postponed product launches in the cosmetics industry. Every week of delay represents lost revenue, diminished market positioning, and reduced relevance for trend-driven products. In a market where speed to market is a critical competitive advantage, slow validation processes can be a significant barrier to success.

Opportunity costs also include the resources diverted from innovation and strategic initiatives. When regulatory professionals are consumed by manual validation tasks, they have less time to focus on higher-value activities, such as regulatory strategy, market expansion, and product innovation.

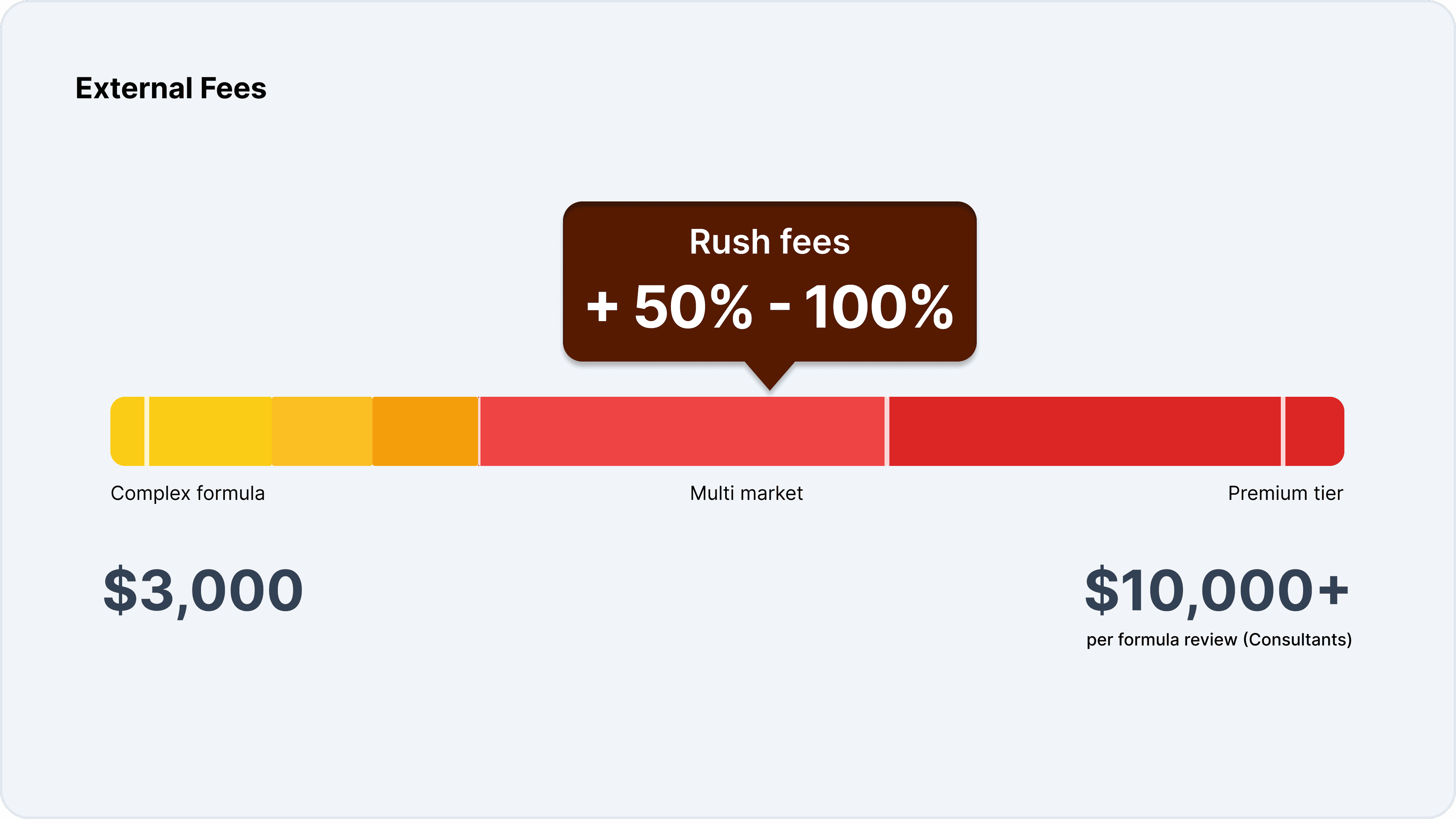

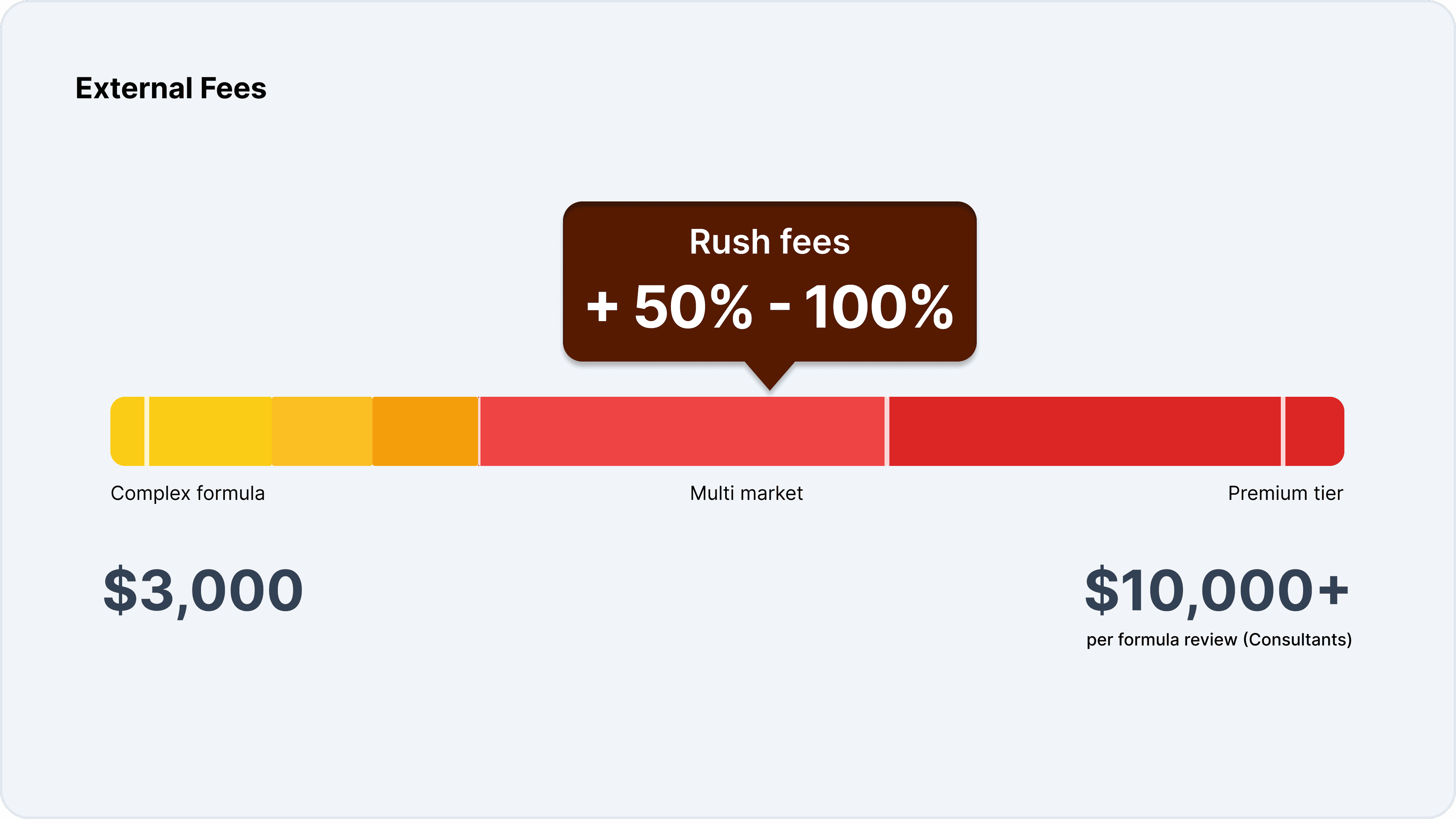

External Fees

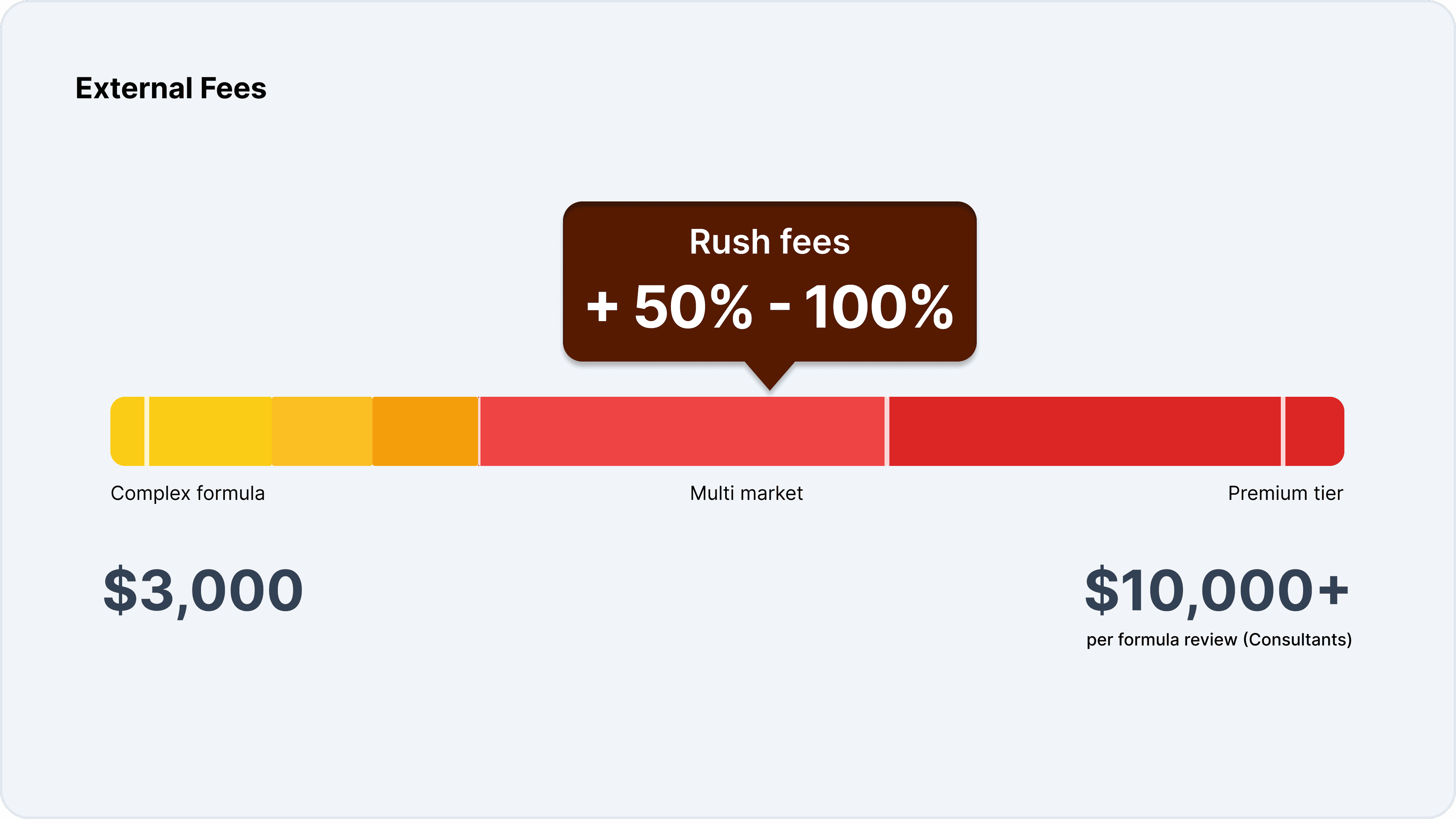

Many organizations rely on external consultants to support formula validation, particularly for complex products or multi-market launches. Consultants typically charge between $3,000 and $10,000 per formula review, with costs increasing for products targeting multiple markets. Rush fees can add 50% to 100% premiums, and ongoing retainers for regulatory monitoring and support are common.

These external fees can quickly add up, particularly for brands with large, diverse product portfolios. The reliance on external expertise also creates dependencies that can limit organizational agility and responsiveness.

Technology Costs

Manual validation processes often rely on a patchwork of technology solutions, including multiple regulatory database subscriptions, custom spreadsheets, and document management systems. Maintaining and integrating these tools can be costly and time-consuming. Training new team members on these systems adds further expense, and integration challenges can limit the effectiveness of the overall process.

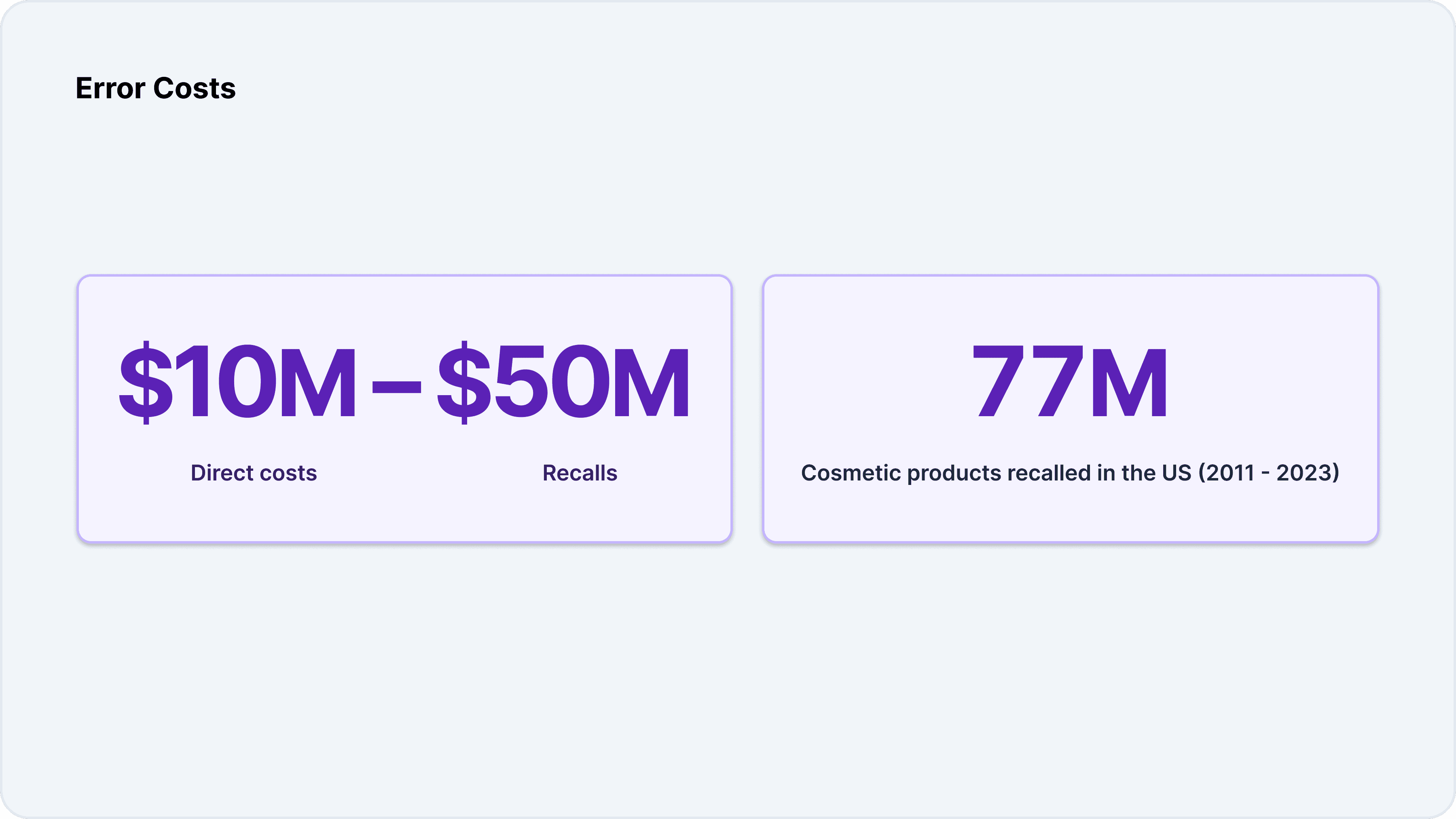

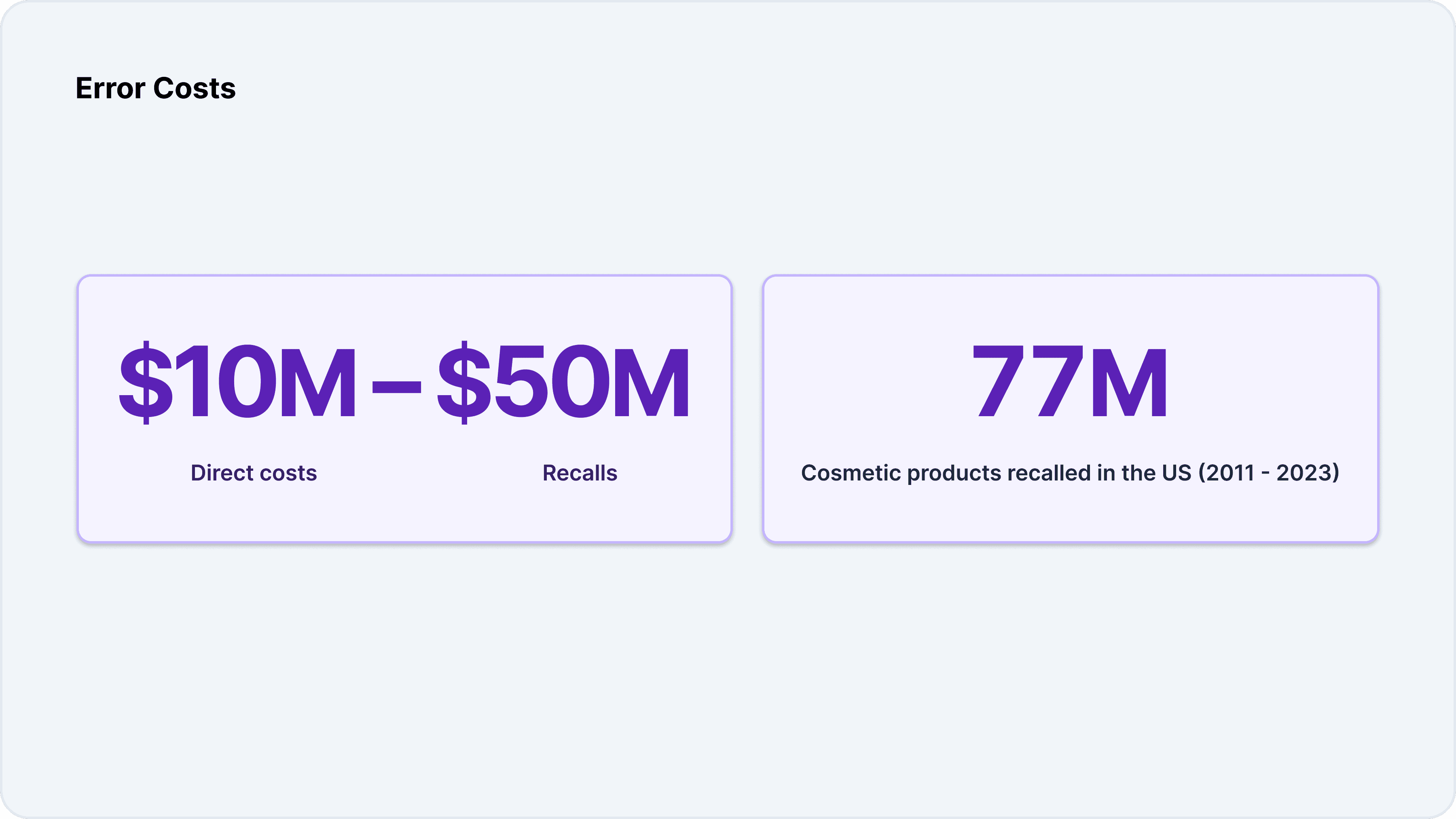

Error Costs

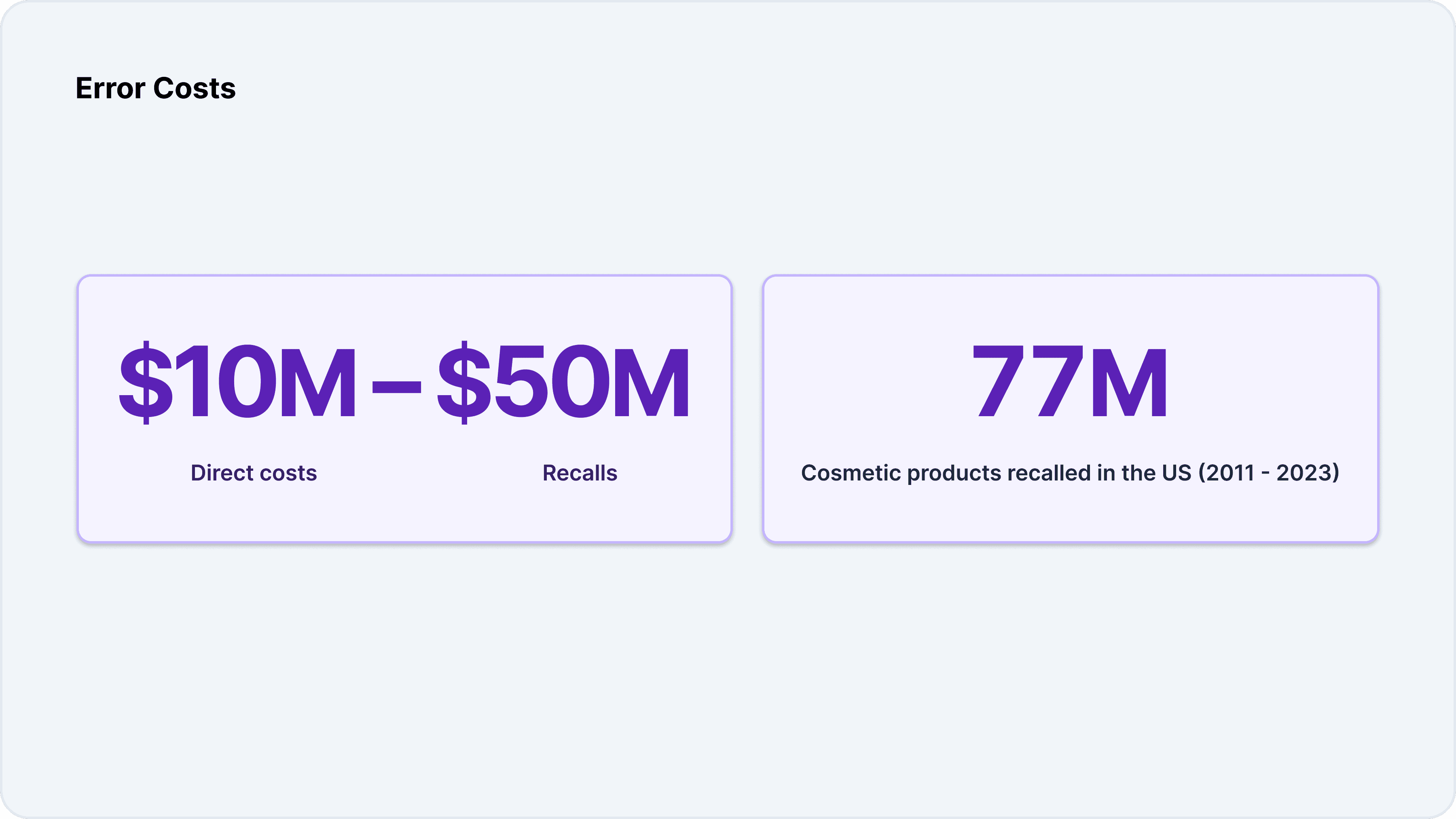

The most significant costs associated with manual validation stem from errors and compliance failures. Product recalls are the most visible and costly consequence, with direct costs often exceeding $10 million, and some recalls surpassing $50 million. Between 2011 and 2023, more than 77 million units of cosmetic products were recalled in the United States alone.

The costs of a recall extend beyond direct expenses. Brand damage, strained retailer relationships, erosion of consumer trust, and legal exposure can have long-lasting impacts on a company’s reputation and bottom line. In some cases, a single recall can threaten the viability of an entire brand.

The Hidden Toll

Beyond these quantifiable costs, manual validation imposes a hidden toll on organizations. The stress and burnout experienced by regulatory professionals, the frustration of delayed launches, and the missed opportunities for innovation all contribute to a culture of risk aversion and incrementalism. In an industry defined by creativity and rapid change, these hidden costs can be as damaging as any financial loss.

Section 5: Stakeholder Impact Across the Supply Chain

The consequences of formula validation—its successes and failures—ripple throughout the entire cosmetics supply chain. Every stakeholder, from brands and manufacturers to retailers and consumers, is affected by the quality and effectiveness of the validation process.

Brands

For brands, the stakes are existential. A single compliance failure can inflict lasting damage on a brand’s reputation, erode consumer trust, and result in significant financial exposure through fines, settlements, and lost sales. Retailers may delist non-compliant products, and innovation can be stifled by the need to navigate complex, uncertain regulatory environments.

Brands also face strategic challenges. The need to validate formulas for multiple markets can constrain innovation and limit the ability to respond quickly to emerging trends. Strategic decisions—such as market entry, product positioning, and portfolio expansion—are all influenced by the perceived risks and costs of compliance.

Manufacturers

Manufacturers are increasingly held accountable for the compliance of the products they produce, even when those products are developed by partner brands. Production disruptions, waste, and quality system burdens can result from compliance failures or late-stage changes. The need to manage multiple formulations, each with its own regulatory requirements, adds complexity and risk.

Client relationships can be strained by compliance challenges, particularly when documentation is incomplete or validation processes are inconsistent. At the same time, manufacturers that excel in compliance can differentiate themselves in the market, add value to brand partners, and secure long-term business.

Third-Party Partners

Third-party partners—including consultants, testing laboratories, and regulatory service providers—play a critical role in formula validation. However, they often operate with incomplete documentation and limited control over the final product. Shared risk without shared control can create tension and increase the potential for errors.

Communication overhead is a significant challenge, as partners must coordinate across time zones, languages, and regulatory frameworks. Regional expertise is essential, but difficult to maintain in a rapidly changing environment.

Retailers

Retailers face their own set of risks and responsibilities. Shelf liability—the risk associated with selling non-compliant products—can expose retailers to legal action and reputational harm. Private-label products add another layer of complexity, as retailers must ensure compliance with products developed by third-party manufacturers.

Supplier verification is a growing burden, with retailers demanding comprehensive compliance documentation before listing products. Consumer trust is at stake, and stringent listing requirements are becoming the norm.

Consumers

Ultimately, consumers are the most important stakeholders in the formula validation process. Health and safety risks associated with restricted ingredients, contamination, or incorrect concentrations can be serious, particularly for vulnerable populations. Undisclosed allergens endanger sensitive individuals, and inaccurate labeling impairs informed decision-making.

Trust is the foundation of the consumer-brand relationship. Compliance failures erode that trust, making it difficult for brands to recover even after corrective action is taken. In an era of social media and instant communication, the consequences of a single misstep can be amplified exponentially.

Section 6: The Global Regulatory Landscape

Navigating the global regulatory landscape is one of the most challenging aspects of formula validation. Each market has its own requirements, and regional differences can be substantial. Understanding these complexities is essential for successful, compliant product launches.

United States: MoCRA

The Modernization of Cosmetics Regulation Act (MoCRA) represents the most significant overhaul of U.S. cosmetics regulations in decades. MoCRA introduces new requirements for facility registration, product listing, adverse event reporting, safety substantiation, allergen disclosure, and Good Manufacturing Practices (GMP). The FDA now has mandatory recall authority, and state-level regulations—such as California’s Proposition 65 and ingredient bans—add further complexity.

MoCRA’s emphasis on documented safety evidence and transparent ingredient disclosure has raised the bar for compliance, requiring brands to invest in more robust validation processes and documentation systems.

European Union: Regulation 1223/2009

The European Union’s Regulation 1223/2009 is widely regarded as the gold standard for cosmetics regulation. It requires preparing a Product Information File (PIF) and a Cosmetic Product Safety Report (CPSR) for each product, as well as designating a Responsible Person accountable for compliance. The regulation includes extensive lists of prohibited and restricted substances, as well as permitted colorants, preservatives, and UV filters.

Notification of products through the Cosmetic Products Notification Portal (CPNP) is mandatory, and labeling requirements are among the most stringent in the world. The EU’s proactive approach to ingredient safety and consumer protection sets a high bar for global brands.

Other Markets

China’s regulatory environment is evolving rapidly, with the National Medical Products Administration (NMPA) introducing new requirements for product registration, ingredient review, and animal testing policies. The Inventory of Existing Cosmetic Ingredients in China (IECIC) is the primary reference for ingredient compliance.

Canada maintains its own Cosmetic Ingredient Hotlist and notification requirements, while the ASEAN region has developed a harmonized scheme with country-specific variations. Japan’s quasi-drug classification and positive ingredient lists add further complexity for brands targeting the Japanese market.

Multi-Market Challenges

The same ingredient may be permitted, restricted, or banned depending on the market. Labeling requirements differ, and claims that are acceptable in one region may cross into drug territory in another. Achieving compliance across multiple markets requires a deep understanding of local regulations, proactive monitoring of regulatory changes, and the ability to adapt quickly to new requirements.

The complexity of the global regulatory landscape underscores the need for robust, scalable validation processes and for adopting technology solutions that can keep pace with change.

Section 7: How AI Is Modernizing Formula Validation

The limitations of manual formula validation are increasingly apparent in today’s fast-paced, complex regulatory environment. Artificial intelligence (AI) is emerging as a transformative force, offering the potential to revolutionize formula validation by automating repetitive tasks, improving accuracy, and enabling real-time compliance.

From Manual to Intelligent Automation

AI-powered platforms can cross-reference cosmetic formulas against regulatory databases in minutes, rather than the weeks required by manual processes. Natural language processing (NLP) algorithms interpret regulatory text, conditions, and exemptions, while machine learning (ML) models improve accuracy over time by learning from past decisions and outcomes.

Automation eliminates the need for repetitive lookups and manual data entry, freeing regulatory professionals to focus on higher-value activities. AI systems can process vast amounts of data, identify patterns and anomalies, and flag potential compliance issues before they become problems.

Speed Without Sacrificing Accuracy

AI-driven validation platforms catch issues that manual review might miss, such as subtle changes in regulatory language or complex interactions between ingredients. Real-time regulatory updates ensure formulas are always validated against the latest requirements, reducing the risk of compliance failures caused by outdated information.

Consistent rule application is another key advantage. AI systems apply the same logic to every formula, eliminating the variability and inconsistency that can result from human interpretation. Problems are identified instantly, allowing formulators to address them before development progresses too far.

Proactive Compliance

One of the most significant benefits of AI is the ability to shift from reactive to proactive compliance. Issues can be flagged during the formulation stage rather than after significant investment in development and testing. Formulators can see regulatory constraints in real time, enabling them to make informed decisions and avoid costly rework.

Proactive compliance also supports faster innovation, as teams can move quickly from concept to launch without being slowed by manual validation bottlenecks.

Enhanced Collaboration

AI-powered platforms centralize data and documentation, replacing scattered spreadsheets and email threads with a single source of truth. All stakeholders—R&D, regulatory, quality, legal, marketing, and external partners—can access the same validated information, improving transparency and collaboration.

Automatic audit trails and reliable version control ensure that every decision is documented and traceable, supporting both internal governance and external audits.

Business Value

The business value of AI-driven formula validation is substantial. Faster launches translate into weeks or even months saved per product, enabling brands to capitalize on trends and respond quickly to market opportunities. Reduced risk means fewer errors, recalls, and delays, while resource optimization allows professionals to focus on strategy and innovation.

Scalability is another key benefit. AI platforms can handle more products and markets without requiring proportional increases in headcount, supporting growth and expansion. The speed and reliability of AI-driven validation can become a powerful competitive differentiator in a crowded marketplace.

Human-AI Partnership

It is important to recognize that AI is not a replacement for human expertise. Rather, it is a tool that augments human capabilities, handling the volume, consistency, and speed required for modern compliance. Regulatory professionals remain essential for judgment, strategy, and decision-making, while AI provides the data-driven foundation for informed action.

The partnership between humans and AI is the future of formula validation—one that combines the best of both worlds to deliver safer, more compliant, and more innovative products.

Section 8: Building a Modern Compliance Program

Embracing the future of formula validation requires more than just adopting new technology. It demands a holistic approach to process improvement, data management, and organizational culture. Building a modern compliance program is an investment in both operational excellence and long-term success.

Assess Current State

The journey begins with a thorough audit of current processes, benchmarking against industry standards, and identifying pain points. This assessment should include a review of documentation practices, workflow efficiency, error rates, and stakeholder satisfaction. Understanding where the organization stands today is essential for setting priorities and measuring progress.

Centralize Data

Centralizing formula, ingredient, supplier, and regulatory information is a foundational step. A single, version-controlled repository ensures that all stakeholders have access to complete, current, and accurate documentation. Clear ownership of data and processes supports accountability and reduces the risk of errors and omissions.

Standardize Processes

Defining standardized workflows with documented criteria and consistent templates or checklists is critical to ensuring repeatable, reliable validation. Escalation paths for complex or ambiguous situations should be clearly defined, enabling teams to address challenges quickly and effectively.

Invest in Tools

Selecting the right technology platform is a key decision. Evaluation criteria should include portfolio coverage, market support, regulatory database integration, automated checks, and collaboration features. Integration with existing systems—such as Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Quality Management Systems (QMS)—should be considered to maximize efficiency and data integrity.

Train Your Team

Technology is only as effective as the people who use it. Comprehensive training ensures that team members understand both the regulatory landscape and the tools at their disposal. Cross-training supports resilience and flexibility, while positioning compliance as an enabler of innovation and growth.

Measure and Improve

Continuous improvement is the hallmark of a modern compliance program. Key metrics—such as time-to-validation, error rates, rework, and launch delays—should be tracked and analyzed. Lessons learned from near-misses and compliance failures should be documented and used to drive process enhancements. Staying current with regulatory developments is essential for maintaining a competitive edge.

Conclusion

Cosmetics formula validation is the unsung hero of the beauty industry—a discipline that protects consumers, preserves brand reputations, and enables access to global markets. In an era of unprecedented complexity, velocity, and regulatory scrutiny, manual validation approaches are increasingly unsustainable. Errors and omissions can ripple across the entire supply chain, driving up costs, delaying innovation, and eroding trust.

Artificial intelligence offers a transformative solution, enabling faster, more accurate validation and freeing professionals to focus on strategy and innovation. Organizations that treat compliance as a competitive capability—rather than a cost center—will not only survive but thrive in the modern marketplace.

The call to action is clear: evaluate your current processes, invest in modern tools, and build a compliance program that accelerates safe, compliant product launches. In today’s world, compliance is not just a requirement—it is a strategic advantage that can define your brand's future and the safety of your consumers. The future of cosmetics is bright for those who embrace the power of intelligent, proactive formula validation.

Introduction

The global cosmetics industry stands as a testament to human ingenuity and the relentless pursuit of beauty, wellness, and self-expression. Surpassing $430 billion in annual value, this market is vast and fiercely competitive, driven by rapid innovation and ever-evolving consumer expectations. Yet, beneath the surface of every new product launch—whether a cutting-edge serum, a vibrant lipstick, or a gentle cleanser—lies a rigorous, often invisible process: formula validation.

Formula validation is the systematic, science-driven discipline that ensures every cosmetic product’s composition meets a complex web of regulatory requirements, safety standards, and brand-specific criteria before it ever reaches the market. This process is not a mere checkbox on a project plan; it is the critical gatekeeper that protects consumers, preserves brand reputations, and enables global market access. The stakes are extraordinarily high. A single non-compliant product can trigger recalls costing tens of millions of dollars, inflict lasting reputational damage, and, most importantly, put consumer health at risk.

The regulatory landscape for cosmetics is evolving at an unprecedented pace. In the United States, the Modernization of Cosmetics Regulation Act (MoCRA) has ushered in the most significant overhaul of cosmetic regulations in decades, raising the bar for safety substantiation, ingredient disclosure, and adverse event reporting. Meanwhile, the European Union continues to refine its already stringent requirements, demanding exhaustive documentation and proactive compliance. These changes have elevated expectations for brands and manufacturers, making formula validation more complex and essential than ever before.

The validation process itself is multifaceted and demanding. It involves a comprehensive review of each ingredient for compliance with regional bans, restrictions, and permitted concentrations. Safety assessments evaluate exposure levels and toxicological profiles, while impurity screenings ensure raw materials are free of harmful contaminants. Claims made on packaging must be substantiated by the formula, and labels must accurately reflect all ingredients and mandatory warnings. Each of these steps is critical, as even minor errors or omissions can cascade through the supply chain, affecting not only brands but also manufacturers, retailers, and ultimately, consumers.

Despite its importance, formula validation remains a largely manual process in many organizations. Regulatory professionals often find themselves buried in spreadsheets, chasing down missing documentation from suppliers, and interpreting ever-changing regulations across multiple markets. This environment is ripe for human error—whether it’s a missed regulatory update, a copy-paste mistake, or an overlooked allergen. The consequences of such errors can be severe, ranging from costly recalls and delayed product launches to legal exposure and erosion of consumer trust.

This article will take you through the end-to-end process of formula validation, shedding light on where errors and omissions most commonly occur and examining the profound impact they can have on all stakeholders in the supply chain. We will explore the true costs of manual compliance, from direct labor and external consulting fees to the hidden toll of near-misses and lost market opportunities. The discussion will also map the global regulatory landscape, illustrating the complexity of achieving compliance across divergent regions and the unique challenges this presents.

Most importantly, we will examine how artificial intelligence is revolutionizing formula validation. AI-powered platforms can now cross-reference formulas against regulatory databases in real time, automate repetitive checks, and provide instant feedback to formulators. This transformation is not about replacing human expertise, but about augmenting it—freeing professionals to focus on strategic decision-making and innovation while ensuring the highest standards of safety and compliance.

In a world where regulatory expectations are only intensifying, organizations that embrace modern, AI-enabled compliance programs will not only protect consumers and preserve their reputations but also gain a decisive competitive edge. The time to evaluate and modernize your formula validation process is now—because in today’s market, compliance is not just a requirement; it is a strategic advantage that can define the future of your brand.

Section 1: What Is Cosmetics Formula Validation?

Cosmetics formula validation is the systematic process of verifying that a product’s composition aligns with all applicable regulatory requirements, safety thresholds, and internal brand standards before it is manufactured at scale or introduced to the market. This discipline is foundational to the responsible development and commercialization of cosmetic products, serving as the bridge between innovation and safe, compliant consumer offerings.

Defining Formula Validation

At its core, formula validation is a comprehensive review of a cosmetic formula's quantitative and qualitative aspects. This review is conducted against a backdrop of complex, often overlapping regulations that vary by country and region. The process is distinct from other critical steps in product development, such as formula development (where the actual product is conceived and iterated), stability testing (which ensures the product maintains its integrity over time), and clinical testing (which may assess efficacy or skin compatibility). Formula validation is the gatekeeper that determines whether a product is ready for manufacturing scale-up and market entry.

The validation process is methodical and data-driven. It begins with a detailed examination of every ingredient in the formula, including their International Nomenclature of Cosmetic Ingredients (INCI) names, concentrations, and sources. Each ingredient is cross-referenced against regulatory databases to ensure it is permitted for use in the target market and that its concentration does not exceed legal limits. This step is crucial, as regulations can differ dramatically between regions—an ingredient allowed in the United States may be restricted or banned in the European Union, and vice versa.

Core Components of Formula Validation

Ingredient Compliance: The first pillar of formula validation is ingredient compliance. This involves checking each INCI ingredient against lists of banned and restricted substances and verifying that permitted ingredients are used within allowable concentrations. Regulatory authorities such as the EU (via Regulation 1223/2009), the US FDA, Health Canada, and others maintain extensive annexes and hotlists that must be meticulously consulted.

Safety Assessment: Beyond regulatory compliance, formula validation requires a robust safety assessment. This typically involves calculating the Margin of Safety (MoS) for each ingredient based on expected exposure levels, reviewing toxicological profiles, and assessing cumulative exposure from multiple sources. The goal is to ensure that the product is not only legally compliant but also safe for its intended use and user population.

Concentration Checks: Certain classes of ingredients—such as preservatives, UV filters, colorants, and fragrances—are subject to strict concentration limits. Formula validation ensures that these substances are present within legal thresholds and that any conditions of use (such as rinse-off versus leave-on) are properly accounted for.

Allergen Identification: Fragrance allergens and sensitizers are a particular focus, as they can pose significant risks to sensitive individuals. Validation includes identifying any substances that require labeling under regional regulations and ensuring that consumers are adequately informed.

Impurity Screening: Raw materials can contain impurities such as heavy metals, residual solvents, or microbial contaminants. Formula validation includes screening for these impurities and verifying that their levels are within the permissible limits defined by regulatory authorities.

Claims Alignment: The claims made on product packaging—whether “hypoallergenic,” “dermatologist-tested,” or “anti-aging”—must be substantiated by the formula itself. Validation ensures that claims are supported by the product’s composition and do not cross into territory regulated as drugs or therapeutic goods.

Label Preparation: Finally, formula validation supports the preparation of accurate ingredient lists and the inclusion of mandatory warnings on product labels. This step is critical for both regulatory compliance and consumer transparency.

Why Formula Validation Is Not Optional

The necessity of formula validation is underscored by the demands of regulatory authorities, retailers, and consumers alike. In the United States, the FDA (under MoCRA), Health Canada, and EU authorities require documented evidence of product safety and compliance. Retailers increasingly demand proof of compliance before listing products, and contract manufacturers require validated formulas to mitigate their own risk. Meanwhile, consumer and advocacy group scrutiny is at an all-time high, with social media amplifying the consequences of any misstep.

In short, formula validation is not a bureaucratic formality—it is an essential discipline that underpins the safety, legality, and success of every cosmetic product in the global marketplace.

Section 2: The Manual Formula Validation Process

Despite the critical importance of formula validation, many organizations still rely on manual processes that are time-consuming, error-prone, and difficult to scale. Understanding the traditional, manual approach to formula validation is essential for appreciating both its limitations and the transformative potential of modern, AI-driven solutions.

Step 1: Gathering Documentation

The manual validation process begins with the collection of extensive documentation. This includes the quantitative formula (detailing every ingredient and its concentration), Technical Data Sheets (TDS), Safety Data Sheets (SDS), Certificates of Analysis (CoA), allergen reports, and International Fragrance Association (IFRA) certificates. Each document provides critical information for assessing compliance and safety.

However, gathering this documentation is rarely straightforward. Suppliers may take days or even weeks to provide the necessary documents, and version control can quickly become a challenge as formulations are updated or revised. Regulatory professionals often find themselves chasing down missing documents, reconciling conflicting information, and managing multiple versions of the same file. This step alone can consume a significant portion of the validation timeline.

Step 2: Ingredient-by-Ingredient Review

Once the documentation is in hand, the next step is a painstaking, ingredient-by-ingredient review. Each ingredient must be cross-referenced against regulatory databases for every target market. In the European Union, this means consulting Regulation 1223/2009 and its annexes, which list prohibited and restricted substances, permitted colorants, preservatives, and UV filters. In the United States, the review must account for FDA regulations, state-level requirements such as California’s Proposition 65, and the new demands of MoCRA. Other markets, such as ASEAN, China (IECIC), and Health Canada (Hotlist), each have their own unique requirements.

This process is labor-intensive and requires a deep understanding of both the regulations and the nuances of each ingredient. Some ingredients may be permitted in one market but restricted or banned in another. Others may be subject to specific conditions of use, such as maximum concentrations or limitations on product type (e.g., rinse-off vs. leave-on). Each ingredient may require checking multiple lists and interpreting complex regulatory language.

Step 3: Safety Calculations

With ingredient compliance established, the next step is to conduct safety calculations. This typically involves calculating the Margin of Safety (MoS) for each ingredient, based on expected exposure levels and toxicological data. The MoS is a critical metric that helps determine whether an ingredient is safe for use at the intended concentration and in the intended product type.

Safety assessments also include a review of cumulative exposure, particularly for ingredients that may be present in multiple products used by the same consumer. Impurity levels must be checked against regulatory limits, and any potential interactions between ingredients must be considered. This step requires both scientific expertise and meticulous attention to detail.

Step 4: Documentation Compilation

Once the safety assessment is complete, the next step is to compile the necessary documentation to support regulatory submissions and internal approvals. In the European Union, this means assembling the Product Information File (PIF), which includes the Cosmetic Product Safety Report (CPSR), ingredient lists, and supporting data. In the United States, documentation must substantiate safety under MoCRA and be available for FDA inspection.

Traceability is essential at this stage. Every decision must be linked to its source, whether a regulatory database, supplier document, or scientific study. Version control and audit trails are critical to ensure that the documentation is accurate, up-to-date, and defensible in the event of an audit or recall.

Step 5: Review and Approval Cycles

The final step in the manual validation process is the review and approval cycle. The compiled documentation is routed through multiple stakeholders, including R&D, regulatory affairs, quality assurance, legal, and marketing. Each group may have its own requirements and perspectives, leading to multiple rounds of revisions and feedback.

Coordination with external partners—such as contract manufacturers, consultants, and testing laboratories—adds another layer of complexity. Final sign-off is required before the product can proceed to manufacturing and market launch.

Timeline Reality

The manual validation process is time-consuming and resource-intensive. For a single formula targeting a single market, the process can take two to four weeks. If the product is intended for multiple markets, the effort multiplies, as each market’s requirements must be addressed separately. Any reformulation—whether to address a compliance issue, improve performance, or respond to supply chain disruptions—restarts the process, adding further delays.

In today’s fast-paced, trend-driven market, these timelines can be a significant barrier to innovation and competitiveness. The manual process, while thorough, is increasingly unsustainable amid growing complexity and accelerating regulatory change.

Section 3: Where Errors and Omissions Occur

Even the most diligent manual validation processes are vulnerable to errors and omissions. The complexity of the regulatory landscape, the volume of documentation, and the reliance on human interpretation create numerous opportunities for mistakes—many of which can have serious consequences.

Human Error

Human error is an unavoidable reality in manual validation. According to industry surveys, 42% of regulatory professionals report having missed at least one requirement during formula validation. The sources of these errors are manifold: spreadsheet mistakes, copy-paste errors, outdated data, and simple fatigue. The sheer volume of information that must be processed—often under tight deadlines—makes it easy for even experienced professionals to overlook critical details.

Inconsistent interpretation of regulations is another common issue. Regulatory language can be ambiguous, and team members may interpret the same requirement differently. This can lead to inconsistent application of rules and, ultimately, non-compliance.

Outdated Information

Regulations governing cosmetics are in constant flux. New ingredients are added to banned lists, concentration limits are revised, and labeling requirements are updated. Manual tracking of these changes across multiple jurisdictions is virtually impossible in real time. As a result, 38% of regulatory professionals admit they may be unaware of critical updates affecting their products.

There is often a lag between the publication of new regulations and their incorporation into internal databases and processes. This creates a risk window during which products may be validated against outdated requirements, exposing the company to compliance failures.

Documentation Gaps

Supplier documentation is the foundation of formula validation, but it is not always complete or reliable. Missing or incomplete Technical Data Sheets, inconsistent quality of Safety Data Sheets, and failure to verify supplier claims are common challenges. Version mismatches—where the documentation does not match the current formula—can lead to incorrect assessments and missed requirements.

The reliance on external partners for documentation adds another layer of complexity. Suppliers may be slow to respond, provide outdated information, or lack the expertise to ensure their documentation meets regulatory standards.

Communication Breakdowns

Formula validation is a cross-functional process that requires coordination between multiple teams and external partners. In many organizations, communication is managed through email-based feedback loops, shared spreadsheets, and ad hoc meetings. This approach is prone to breakdowns: context is lost over time, feedback is overlooked, and critical information falls through the cracks.

Siloed processes further exacerbate the problem. When teams operate independently, there is a risk that important decisions and updates are not communicated effectively, leading to inconsistent or incomplete validation.

Calculation Mistakes

Safety calculations—such as Margin of Safety assessments—are complex and require precise data and careful interpretation. Errors in these calculations can result from incorrect input data, misinterpretation of conditions of use, or incorrect product categorization. Cumulative exposure assessments, which require consideration of multiple products and use scenarios, are particularly challenging.

These mistakes can have serious consequences, as they may lead to the approval of unsafe products or the unnecessary rejection of compliant formulas.

Hidden Costs of Near-Misses

Not all errors result in immediate compliance failures. Many are caught late in the process—during final review, external audits, or even after market launch. These near-misses can delay product launches, consume valuable resources in rework, and erode confidence in the validation process. Unfortunately, near-misses are rarely documented or analyzed, preventing organizations from learning from their mistakes and improving their processes.

The cumulative impact of these errors and omissions is significant. They not only increase the risk of compliance failures but also drive up costs, delay innovation, and strain relationships across the supply chain.

Section 4: The True Cost of Manual Compliance

The costs associated with manual formula validation extend far beyond the direct labor required to complete the process. They encompass opportunity costs, external fees, technology investments, and the potentially devastating consequences of errors and recalls. Understanding the full scope of these costs is essential for making informed decisions about process improvement and technology adoption.

Direct Labor Costs

Manual formula validation is labor-intensive. Regulatory teams spend an estimated 40% of their workweek researching regulations, gathering documentation, and conducting ingredient reviews. For a small compliance team, this can translate to approximately $240,000 in annual labor costs. Larger organizations, with more products and markets to manage, can see these costs multiply rapidly.

These labor costs are not just a function of the number of products but also the complexity of each formula and the number of markets targeted. Multi-market launches require separate validations for each jurisdiction, further increasing the workload.

Opportunity Costs

Compliance delays are a leading cause of postponed product launches in the cosmetics industry. Every week of delay represents lost revenue, diminished market positioning, and reduced relevance for trend-driven products. In a market where speed to market is a critical competitive advantage, slow validation processes can be a significant barrier to success.

Opportunity costs also include the resources diverted from innovation and strategic initiatives. When regulatory professionals are consumed by manual validation tasks, they have less time to focus on higher-value activities, such as regulatory strategy, market expansion, and product innovation.

External Fees

Many organizations rely on external consultants to support formula validation, particularly for complex products or multi-market launches. Consultants typically charge between $3,000 and $10,000 per formula review, with costs increasing for products targeting multiple markets. Rush fees can add 50% to 100% premiums, and ongoing retainers for regulatory monitoring and support are common.

These external fees can quickly add up, particularly for brands with large, diverse product portfolios. The reliance on external expertise also creates dependencies that can limit organizational agility and responsiveness.

Technology Costs

Manual validation processes often rely on a patchwork of technology solutions, including multiple regulatory database subscriptions, custom spreadsheets, and document management systems. Maintaining and integrating these tools can be costly and time-consuming. Training new team members on these systems adds further expense, and integration challenges can limit the effectiveness of the overall process.

Error Costs

The most significant costs associated with manual validation stem from errors and compliance failures. Product recalls are the most visible and costly consequence, with direct costs often exceeding $10 million, and some recalls surpassing $50 million. Between 2011 and 2023, more than 77 million units of cosmetic products were recalled in the United States alone.

The costs of a recall extend beyond direct expenses. Brand damage, strained retailer relationships, erosion of consumer trust, and legal exposure can have long-lasting impacts on a company’s reputation and bottom line. In some cases, a single recall can threaten the viability of an entire brand.

The Hidden Toll

Beyond these quantifiable costs, manual validation imposes a hidden toll on organizations. The stress and burnout experienced by regulatory professionals, the frustration of delayed launches, and the missed opportunities for innovation all contribute to a culture of risk aversion and incrementalism. In an industry defined by creativity and rapid change, these hidden costs can be as damaging as any financial loss.

Section 5: Stakeholder Impact Across the Supply Chain

The consequences of formula validation—its successes and failures—ripple throughout the entire cosmetics supply chain. Every stakeholder, from brands and manufacturers to retailers and consumers, is affected by the quality and effectiveness of the validation process.

Brands

For brands, the stakes are existential. A single compliance failure can inflict lasting damage on a brand’s reputation, erode consumer trust, and result in significant financial exposure through fines, settlements, and lost sales. Retailers may delist non-compliant products, and innovation can be stifled by the need to navigate complex, uncertain regulatory environments.

Brands also face strategic challenges. The need to validate formulas for multiple markets can constrain innovation and limit the ability to respond quickly to emerging trends. Strategic decisions—such as market entry, product positioning, and portfolio expansion—are all influenced by the perceived risks and costs of compliance.

Manufacturers

Manufacturers are increasingly held accountable for the compliance of the products they produce, even when those products are developed by partner brands. Production disruptions, waste, and quality system burdens can result from compliance failures or late-stage changes. The need to manage multiple formulations, each with its own regulatory requirements, adds complexity and risk.

Client relationships can be strained by compliance challenges, particularly when documentation is incomplete or validation processes are inconsistent. At the same time, manufacturers that excel in compliance can differentiate themselves in the market, add value to brand partners, and secure long-term business.

Third-Party Partners

Third-party partners—including consultants, testing laboratories, and regulatory service providers—play a critical role in formula validation. However, they often operate with incomplete documentation and limited control over the final product. Shared risk without shared control can create tension and increase the potential for errors.

Communication overhead is a significant challenge, as partners must coordinate across time zones, languages, and regulatory frameworks. Regional expertise is essential, but difficult to maintain in a rapidly changing environment.

Retailers

Retailers face their own set of risks and responsibilities. Shelf liability—the risk associated with selling non-compliant products—can expose retailers to legal action and reputational harm. Private-label products add another layer of complexity, as retailers must ensure compliance with products developed by third-party manufacturers.

Supplier verification is a growing burden, with retailers demanding comprehensive compliance documentation before listing products. Consumer trust is at stake, and stringent listing requirements are becoming the norm.

Consumers

Ultimately, consumers are the most important stakeholders in the formula validation process. Health and safety risks associated with restricted ingredients, contamination, or incorrect concentrations can be serious, particularly for vulnerable populations. Undisclosed allergens endanger sensitive individuals, and inaccurate labeling impairs informed decision-making.

Trust is the foundation of the consumer-brand relationship. Compliance failures erode that trust, making it difficult for brands to recover even after corrective action is taken. In an era of social media and instant communication, the consequences of a single misstep can be amplified exponentially.

Section 6: The Global Regulatory Landscape

Navigating the global regulatory landscape is one of the most challenging aspects of formula validation. Each market has its own requirements, and regional differences can be substantial. Understanding these complexities is essential for successful, compliant product launches.

United States: MoCRA

The Modernization of Cosmetics Regulation Act (MoCRA) represents the most significant overhaul of U.S. cosmetics regulations in decades. MoCRA introduces new requirements for facility registration, product listing, adverse event reporting, safety substantiation, allergen disclosure, and Good Manufacturing Practices (GMP). The FDA now has mandatory recall authority, and state-level regulations—such as California’s Proposition 65 and ingredient bans—add further complexity.

MoCRA’s emphasis on documented safety evidence and transparent ingredient disclosure has raised the bar for compliance, requiring brands to invest in more robust validation processes and documentation systems.

European Union: Regulation 1223/2009

The European Union’s Regulation 1223/2009 is widely regarded as the gold standard for cosmetics regulation. It requires preparing a Product Information File (PIF) and a Cosmetic Product Safety Report (CPSR) for each product, as well as designating a Responsible Person accountable for compliance. The regulation includes extensive lists of prohibited and restricted substances, as well as permitted colorants, preservatives, and UV filters.

Notification of products through the Cosmetic Products Notification Portal (CPNP) is mandatory, and labeling requirements are among the most stringent in the world. The EU’s proactive approach to ingredient safety and consumer protection sets a high bar for global brands.

Other Markets

China’s regulatory environment is evolving rapidly, with the National Medical Products Administration (NMPA) introducing new requirements for product registration, ingredient review, and animal testing policies. The Inventory of Existing Cosmetic Ingredients in China (IECIC) is the primary reference for ingredient compliance.

Canada maintains its own Cosmetic Ingredient Hotlist and notification requirements, while the ASEAN region has developed a harmonized scheme with country-specific variations. Japan’s quasi-drug classification and positive ingredient lists add further complexity for brands targeting the Japanese market.

Multi-Market Challenges

The same ingredient may be permitted, restricted, or banned depending on the market. Labeling requirements differ, and claims that are acceptable in one region may cross into drug territory in another. Achieving compliance across multiple markets requires a deep understanding of local regulations, proactive monitoring of regulatory changes, and the ability to adapt quickly to new requirements.

The complexity of the global regulatory landscape underscores the need for robust, scalable validation processes and for adopting technology solutions that can keep pace with change.

Section 7: How AI Is Modernizing Formula Validation

The limitations of manual formula validation are increasingly apparent in today’s fast-paced, complex regulatory environment. Artificial intelligence (AI) is emerging as a transformative force, offering the potential to revolutionize formula validation by automating repetitive tasks, improving accuracy, and enabling real-time compliance.

From Manual to Intelligent Automation

AI-powered platforms can cross-reference cosmetic formulas against regulatory databases in minutes, rather than the weeks required by manual processes. Natural language processing (NLP) algorithms interpret regulatory text, conditions, and exemptions, while machine learning (ML) models improve accuracy over time by learning from past decisions and outcomes.

Automation eliminates the need for repetitive lookups and manual data entry, freeing regulatory professionals to focus on higher-value activities. AI systems can process vast amounts of data, identify patterns and anomalies, and flag potential compliance issues before they become problems.

Speed Without Sacrificing Accuracy

AI-driven validation platforms catch issues that manual review might miss, such as subtle changes in regulatory language or complex interactions between ingredients. Real-time regulatory updates ensure formulas are always validated against the latest requirements, reducing the risk of compliance failures caused by outdated information.

Consistent rule application is another key advantage. AI systems apply the same logic to every formula, eliminating the variability and inconsistency that can result from human interpretation. Problems are identified instantly, allowing formulators to address them before development progresses too far.

Proactive Compliance

One of the most significant benefits of AI is the ability to shift from reactive to proactive compliance. Issues can be flagged during the formulation stage rather than after significant investment in development and testing. Formulators can see regulatory constraints in real time, enabling them to make informed decisions and avoid costly rework.

Proactive compliance also supports faster innovation, as teams can move quickly from concept to launch without being slowed by manual validation bottlenecks.

Enhanced Collaboration

AI-powered platforms centralize data and documentation, replacing scattered spreadsheets and email threads with a single source of truth. All stakeholders—R&D, regulatory, quality, legal, marketing, and external partners—can access the same validated information, improving transparency and collaboration.

Automatic audit trails and reliable version control ensure that every decision is documented and traceable, supporting both internal governance and external audits.

Business Value

The business value of AI-driven formula validation is substantial. Faster launches translate into weeks or even months saved per product, enabling brands to capitalize on trends and respond quickly to market opportunities. Reduced risk means fewer errors, recalls, and delays, while resource optimization allows professionals to focus on strategy and innovation.

Scalability is another key benefit. AI platforms can handle more products and markets without requiring proportional increases in headcount, supporting growth and expansion. The speed and reliability of AI-driven validation can become a powerful competitive differentiator in a crowded marketplace.

Human-AI Partnership

It is important to recognize that AI is not a replacement for human expertise. Rather, it is a tool that augments human capabilities, handling the volume, consistency, and speed required for modern compliance. Regulatory professionals remain essential for judgment, strategy, and decision-making, while AI provides the data-driven foundation for informed action.

The partnership between humans and AI is the future of formula validation—one that combines the best of both worlds to deliver safer, more compliant, and more innovative products.

Section 8: Building a Modern Compliance Program

Embracing the future of formula validation requires more than just adopting new technology. It demands a holistic approach to process improvement, data management, and organizational culture. Building a modern compliance program is an investment in both operational excellence and long-term success.

Assess Current State

The journey begins with a thorough audit of current processes, benchmarking against industry standards, and identifying pain points. This assessment should include a review of documentation practices, workflow efficiency, error rates, and stakeholder satisfaction. Understanding where the organization stands today is essential for setting priorities and measuring progress.

Centralize Data

Centralizing formula, ingredient, supplier, and regulatory information is a foundational step. A single, version-controlled repository ensures that all stakeholders have access to complete, current, and accurate documentation. Clear ownership of data and processes supports accountability and reduces the risk of errors and omissions.

Standardize Processes

Defining standardized workflows with documented criteria and consistent templates or checklists is critical to ensuring repeatable, reliable validation. Escalation paths for complex or ambiguous situations should be clearly defined, enabling teams to address challenges quickly and effectively.

Invest in Tools

Selecting the right technology platform is a key decision. Evaluation criteria should include portfolio coverage, market support, regulatory database integration, automated checks, and collaboration features. Integration with existing systems—such as Product Lifecycle Management (PLM), Enterprise Resource Planning (ERP), and Quality Management Systems (QMS)—should be considered to maximize efficiency and data integrity.

Train Your Team

Technology is only as effective as the people who use it. Comprehensive training ensures that team members understand both the regulatory landscape and the tools at their disposal. Cross-training supports resilience and flexibility, while positioning compliance as an enabler of innovation and growth.

Measure and Improve

Continuous improvement is the hallmark of a modern compliance program. Key metrics—such as time-to-validation, error rates, rework, and launch delays—should be tracked and analyzed. Lessons learned from near-misses and compliance failures should be documented and used to drive process enhancements. Staying current with regulatory developments is essential for maintaining a competitive edge.

Conclusion

Cosmetics formula validation is the unsung hero of the beauty industry—a discipline that protects consumers, preserves brand reputations, and enables access to global markets. In an era of unprecedented complexity, velocity, and regulatory scrutiny, manual validation approaches are increasingly unsustainable. Errors and omissions can ripple across the entire supply chain, driving up costs, delaying innovation, and eroding trust.

Artificial intelligence offers a transformative solution, enabling faster, more accurate validation and freeing professionals to focus on strategy and innovation. Organizations that treat compliance as a competitive capability—rather than a cost center—will not only survive but thrive in the modern marketplace.

The call to action is clear: evaluate your current processes, invest in modern tools, and build a compliance program that accelerates safe, compliant product launches. In today’s world, compliance is not just a requirement—it is a strategic advantage that can define your brand's future and the safety of your consumers. The future of cosmetics is bright for those who embrace the power of intelligent, proactive formula validation.

Introduction

The global cosmetics industry stands as a testament to human ingenuity and the relentless pursuit of beauty, wellness, and self-expression. Surpassing $430 billion in annual value, this market is vast and fiercely competitive, driven by rapid innovation and ever-evolving consumer expectations. Yet, beneath the surface of every new product launch—whether a cutting-edge serum, a vibrant lipstick, or a gentle cleanser—lies a rigorous, often invisible process: formula validation.

Formula validation is the systematic, science-driven discipline that ensures every cosmetic product’s composition meets a complex web of regulatory requirements, safety standards, and brand-specific criteria before it ever reaches the market. This process is not a mere checkbox on a project plan; it is the critical gatekeeper that protects consumers, preserves brand reputations, and enables global market access. The stakes are extraordinarily high. A single non-compliant product can trigger recalls costing tens of millions of dollars, inflict lasting reputational damage, and, most importantly, put consumer health at risk.

The regulatory landscape for cosmetics is evolving at an unprecedented pace. In the United States, the Modernization of Cosmetics Regulation Act (MoCRA) has ushered in the most significant overhaul of cosmetic regulations in decades, raising the bar for safety substantiation, ingredient disclosure, and adverse event reporting. Meanwhile, the European Union continues to refine its already stringent requirements, demanding exhaustive documentation and proactive compliance. These changes have elevated expectations for brands and manufacturers, making formula validation more complex and essential than ever before.

The validation process itself is multifaceted and demanding. It involves a comprehensive review of each ingredient for compliance with regional bans, restrictions, and permitted concentrations. Safety assessments evaluate exposure levels and toxicological profiles, while impurity screenings ensure raw materials are free of harmful contaminants. Claims made on packaging must be substantiated by the formula, and labels must accurately reflect all ingredients and mandatory warnings. Each of these steps is critical, as even minor errors or omissions can cascade through the supply chain, affecting not only brands but also manufacturers, retailers, and ultimately, consumers.

Despite its importance, formula validation remains a largely manual process in many organizations. Regulatory professionals often find themselves buried in spreadsheets, chasing down missing documentation from suppliers, and interpreting ever-changing regulations across multiple markets. This environment is ripe for human error—whether it’s a missed regulatory update, a copy-paste mistake, or an overlooked allergen. The consequences of such errors can be severe, ranging from costly recalls and delayed product launches to legal exposure and erosion of consumer trust.